Afternoon Update -Loss of Momentum

3:15 p.m. ET

*The market has come down a little since I put this post together.

Trade has been very quiet since the last update with the major averages more or less sideways, the S&P right at the $3130 target zone highlighted in last night’s Daily Wrap.

SPX +1.6%, Dow +1.8% (Dow Transports lagging +1.1%), NASDAQ +1.4% lagging, Small Caps +2.3% leading.

Both VIX (+2.7%) and VVIX (+5.1%) show notable relative strength.

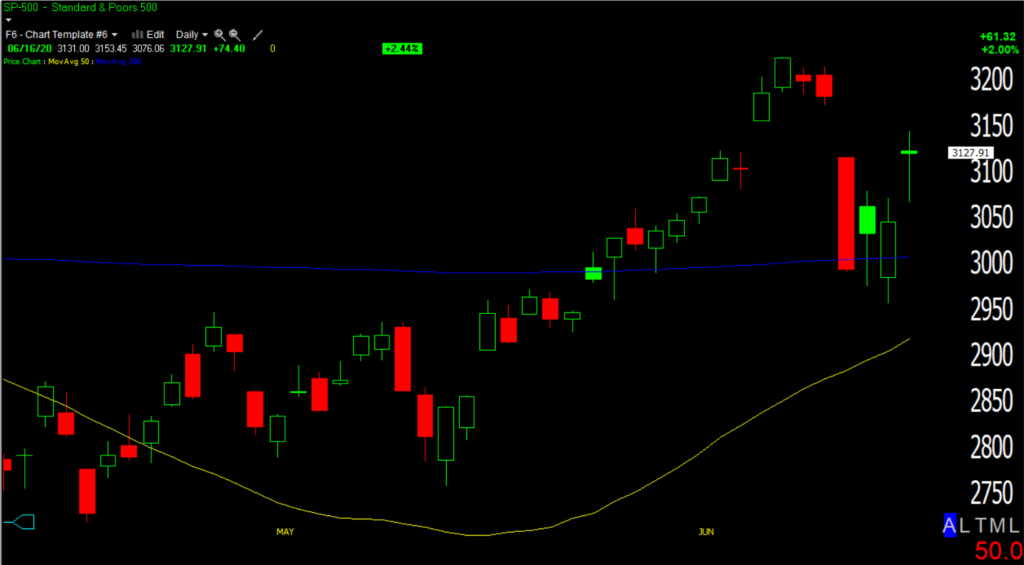

SP-500 (15m) at the $3130 zone

SP-500 (15m) at the $3130 zone

On a daily chart (currently) S&P has a Doji Star (loss of momentum/potential reversal candlestick).

As does the Dow…

Dow (daily) right at its 200-day.

The NASDAQ 100 and Small Caps are fairly close to a hanging man candlestick. As the name implies it has a bearish bias, it too is a higher probability reversal candlestick. Nearly all S&P sectors have some version of either a star or hanging man candlestick.

Yields have been sideways this afternoon too. The yield curve is steeper from this morning, but sideways since.

VIX futures (1m) mirror the positive divergence in VXX.

VIX futures (1m) mirror the positive divergence in VXX.

Currencies are similarly sideways since several pairs showed a defensive posture earlier.

The day on the whole is bullish. The afternoon looks like the market is running out of upside momentum. There’s no risk off signal like early last week, there are some hints of risk whether that be the drop in currencies earlier, the relative strength in volatility or the extreme high VVIX reading (149).

Internals look like they’ll come in with a 1-day overbought condition, which would bolster the view that the market may have run out of upside momentum I’m browsing around for potential trades. I don’t see a really strong edge yet, but we’re at a point where it may be close. I’m going to get this post out a little earlier than usual, but I’ll send out another update if the situation develops more.