Did the Fed & Powell Pivot (Dovishly) Last Week?

This is an abridged version of Friday’s subscriber post, The Afternoon Update (some of the stuff in there is for subscribers only). Last Wednesday’s FOMC came in as expected with a 75 basis point rate hike. Admittedly, that’s a decent hike after the last 75 bp hike. I’m not 100% certain, but I think it’s been over 20 years since the Fed has hiked 75 bp even once, and it was around 1984 that they hiked by 75 bp at two consecutive meetings. At face value, it “seems” like the Fed is taking the fight to inflation, but at a current Fed Funds Rate of 2.25% to 2.5% and inflation (as per the June CPI) running above 9%, the Fed is WAY, WAY behind the curve. Around March of 2021 I was showing my subscribers that inflation wasn’t looking transitory, but entrenched. The Fed was still saying they believed inflation was transitory as an effect of COVID lockdowns and as people got vaccinated and supply chains returned to normal, so would inflationary pressures.

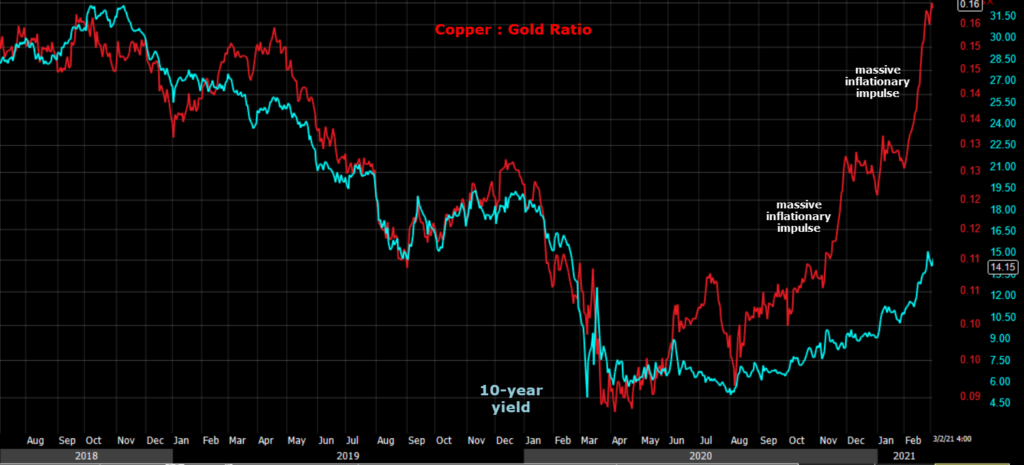

My view back in March/April of 2021 was that inflation was a much bigger problem and it wasn’t just my opinion. In fact I rarely share my opinion unless I have hard data, charts or evidence to back it up, otherwise it’s just an opinion and you know what they say about opinions. For me, it was the Copper to Gold Ratio soaring and suggesting the 10-year yield should be at least double what it was at the time. Let’s say on average the 10-year yield was around 1.50%, the Copper-Gold Ratio was saying it should be closer to 3%, and thus the Fed was not only not being realistic about inflation, but was falling behind the curve fast.

I also said dozens of times in 2021 that if forced to choose between supporting the economy with low or a ZERO Fed funds rate, and fighting inflation (by hiking rates), the Fed would choose hiking rates and fighting inflation as it’s the much worse of the two evils and much more difficult to eradicate. To be clear, I don’t think the Fed caused inflation, but they certainly exacerbated it. In August of 2021 I pointed out to my subscribers that on the very same week the S&P doubled from the COVID crash lows, the Fed’s balance sheet had also doubled from $4.1 trillion to $8.2 trillion – the very same week, and this says nothing of the Fed’s extremely easy ZERO Interest Rate Policy (ZIRP).

I’m not going to go into the particulars of why I think the Copper:Gold ratio is an amazing macro indicator as it applies to inflation & deflation. I’ve used it many times before and found it to be incredibly insightful as a macro indicator. So here’s what the chart of the Copper:Gold ratio and 10-year yield looked like around March of 2021, when I as pounding the table for subscribers with my view that the Fed’s view of inflation as, “Transitory”, was almost certainly wrong, and they were already WAY behind the curve in the fight against inflation, not even having realistically and seriously recognized the problem.

This is a daily chart of the Copper – Gold ratio (red) and 10-year yield (light blue) as of March 2, 2021. The last time the Copper:Gold ratio was at this level, the 10-year yield was above 3.2%, but at the time the 10-year yield was at just 1.41%. The Copper:Gold ratio was saying that inflation was getting out of control, and that interest rates were not reflecting that, they were already way behind the curve, less than half of what they should have been if a free market had set rates, rather than depended on the Fed’s forecast of “transitory inflation”, which was proven to be wrong. This was pretty much a year before the Fed took any action, or even came around to acknowledging what was already clear to the average American. Inflation was causing pain.

With that little backstory, here are the relevant excerpts from my post last Friday, the Afternoon Update, which followed Wednesday’s FOMC, and more importantly to me, Powell’s press conference after.

Excerpts From Friday, July 29th Afternoon Update…

“What’s been bothering more in recent days is less tangible for the immediate near term market direction and that’s the Fed’s direction. You could almost say we got a Fed dovish pivot this week. There had been talk about a Fed rate hike pause in September, heck it was responsible for the May rally until Fed members had to walk it back. But in a sense we did get a dovish pivot in that the Fed gave up the tool of forward guidance. For example, had Powell given forward guidance as they have been and said, “It looks likely we’ll go another 75 basis points in September”, then Wednesday afternoon and every day until September, the market would be tightening financial conditions on its own and fighting inflation before the Fed ever made a move in September. Instead, Powell said, “we’re going on a meeting by meeting basis”. That means the market is left to its own devices until the next meeting, no forward guidance to tighten financial conditions and fight inflation in the meantime. Now that may be, and probably is a good thing for the equity market until we get to September, but let me tell you what really concerns me.

Inflation is horrible, it’s horrendous. I watched it as a young boy destroy my family’s work (and ultimately my family) as my father was a general contractor and built his first spec-home in the early 1980’s using his own money at great sacrifice to our family, but he couldn’t sell that home for 2 years after its completion because inflation was running wild in the early 1980’s and that meant my father was making two mortgage payments – one on our home, and one on the home he borrowed to build. Then Fed chair Paul Volcker lifted the Fed funds rate so high that 30-year mortgages were 18%, so as you can imagine, people were not buying homes like they are today. Don’t get me wrong, Volcker did what had to be done to break the back of inflation, and that’s what worries me about Powell.

In my market career I’ve seen 4 Fed chairs – Greenspan, Bernanke, Yellen and Powell and I don’t recall any of them, until Powell, being a political animal. The Fed is supposed to have independence from politician’s for a reason. If you let politicians set monetary policy what do you think they are going to do? What’s good for the economy long term after they are gone? Or what’s good for them in the moment? Do you think it was politically popular when Paul Volcker lifted the Fed funds rate to 20% to kill inflation? No way. What I can’t wrap my head around is how Powell is going to claim the Fed has lifted rates enough to get to neutral as he just said Wednesday, when the Fed funds rate is 2.25% to 2.50%, and when inflation is running at 9.1% (per June CPI). To kill inflation you usually have to get rates ABOVE inflation, not a quarter of inflation. Now we can argue semantics and say, “Well Powell didn’t say the Fed is done hiking”, and they probably are not, but they gave up a powerful policy tool in forward guidance that would have been working to tighten financial conditions between meetings.

And hey, we saw the Copper:Gold ratio break trend, maybe inflation is breaking, or maybe like the early 1980’s it makes a resurgence and we have a double-dip recession.

I really liked Powell when he first came in as Fed chair. I read what he said as a Fed governor and he seemed very bright, he understood markets, he wasn’t afraid to speak his mind and disagree with the rest of the committee and the committee chair, he had common sense which was not common at the Fed at the time, so I had great hopes for him right up until 2018. What I saw in 2018 was a Fed chair who recognized that to fight a garden variety recession, you had to have the Fed funds rate at at least 5%, because historically it takes 500 basis points in rate cuts to deal with a recession without having to resort to printing money and buying assets, which is eventually going to cause inflation as it ultimately did, or at least exacerbated.

In early October of 2018 Powell made clear in an interview that he didn’t know where the neutral rate was, but it was higher. The next day the market started a sell-off that resulted in a 20% decline in the S&P from October to the end of December – Christmas Eve to be exact. In mid December the Fed hiked again. Powell was telling the market, “I don’t care about your tantrum, I’m going to do what I think is right for the long term health of the economy”. Then we got that fateful Christmas Eve meeting of the President’s Working Group on Financial Markets that was called by then Trump Treasury Secretary, Steve Mnuchin. The working group is also known as, “The Plunge Protection Team”. It was clear that President Trump had enough of the market decline and something was to be done. We got the Christmas Eve meeting and that was the last day of the market plunge. Powell came back from the meeting a changed man. He made the dovish pivot and markets soared to all time new highs. A few meetings later and Powell was cutting rates and buying billions a month in assets. It was clear by January of 2019 that this was the first Fed chair who was NOT politically independent, but was bought and paid for and it was a GREAT disappointment to me because of all of the things I had read from Powell before he became Fed chair. He held a lot of promise to be an amazing Fed chair that did what was right for the economy even when it wasn’t popular.

Fast forward to this week, and I saw it again.

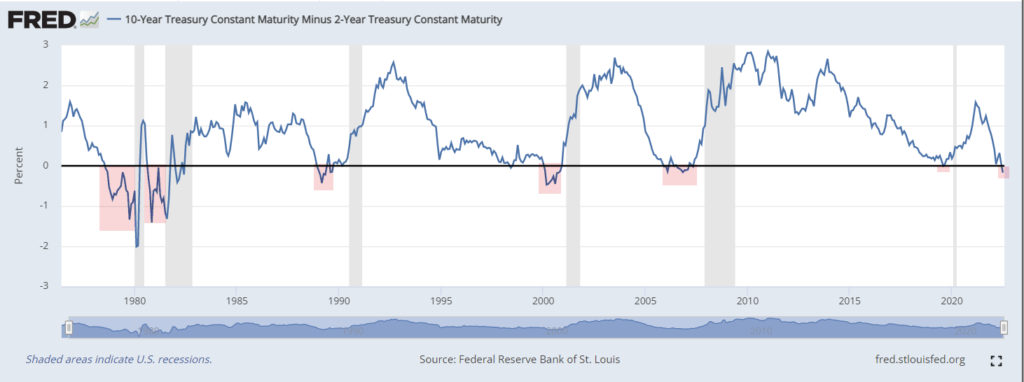

I’ve been saying since last year when the Copper:Gold Ratio spiked parabolically, symbolizing inflation was not transitory, but embedded, that the Fed would have to choose between fighting inflation, and supporting the economy and that inflation was by FAR the worse of the two evils and the Fed WOULD absolutely throw the economy into recession in order to get inflation under control. We found out this week that I was right as the Q2 Advance GDP came in and showed a second consecutive quarter of negative GDP. That is by every, and all definitions, a recession. There’s no other qualifier for a recession, just 2 back to back quarters of negative GDP. That is it. Employment gains don’t matter. We’ve had several recessions in which there have been employment gains during the first half of the recession, but it was still a recession. My point is, there is no other metric used to define a recession other than 2 consecutive quarters of negative GDP, which we got on Thursday. And don’t forget that the yield curve, one of the most accurate forecasters of a recession, and one which has called every U.S. recession since at least WWII by inverting, did so, it inverted and as reliable as “Old faithful”, called the recession that the hard economic data this week now confirms.

2s-10s yield curve with inversions highlighted in red, and recession shading in gray. EVERY TIME!

2s-10s yield curve with inversions highlighted in red, and recession shading in gray. EVERY TIME!

Now it seems we are being bombarded with economists, politicians, former and current Fed chiefs all trying to redefine a recession. Even Wikipedia redefined a recession and then locked the page! A definition that has been in place as long as I can remember. The average American is being gaslighted, hoodwinked, and bamboozled into either buying into the establishment narrative of what a recession is, or feeling like we have to question our own sanity. Here’s former President Bill Clinton as he leaves office, welcoming incoming President George Bush, giving the very common, very correct definition of a recession…

"A recession is two quarters in a row of negative growth."

— President Clinton, Dec. 19, 2000 pic.twitter.com/h04jcPX7P3

— Howard Mortman (@HowardMortman) July 28, 2022

In my opinion, there is absolutely no way on earth that the most powerful man on earth, the Fed chair, didn’t know about the advance GDP print the very day before it came out. There’s no way. Plus the Fed has their own models, so it’s almost certain he knew about the recession without the advance GDP print out the very next morning.

Yet, during Powell press conference he parrotted every talking point coming from the White House, whether it was that of his predecessor at the Fed as chair, Janet Yellen, who now serves as President Biden’s Treasury Secretary who swore up and down there was no recession…

TREASURY SEC. JANET YELLEN: “This is not an economy that’s in recession. We’re in a period of transition in which growth is slowing, and that’s necessary and appropriate."pic.twitter.com/tzRtURrUH8

— Breaking911 (@Breaking911) July 25, 2022

Or whether it was any of Biden’s surrogates or economic advisors who have been dutifully dispatched every morning to tell the country there’s no recession, but rather a “Transition”…

🇺🇸 White House Press Secretary Karine Jean-Pierre denies claims that the US is in a recession, says "we are in a transition."

(via @TheView) pic.twitter.com/sqmVK7uhk0

— Watcher.Guru (@WatcherGuru) July 28, 2022

Or the President himself that says the same…..

Joe Biden again claims "we're not in a recession." pic.twitter.com/7dcGm239eO

— TheBlaze (@theblaze) July 28, 2022

Then this on Wednesday….

Jerome Powell: "I do not think the US is currently in a recession." https://t.co/wcdxK8NLlv pic.twitter.com/jMnY63rsDD

— Bloomberg (@business) July 28, 2022

To hear Powell parroting these same words, these same talking points during his press conference on Wednesday after the FOMC was, well to me, it was heartbreaking, especially considering that the very next morning we got the Q2 Advance GDP that showed that in fact YES, the U.S. economy is in recession as defined by 2 quarters of back-to-back negative GDP.

The proof is in the pudding.

More to the point it showed once again that Powell is absolutely a political creature and not the independent Fed chair that the Federal Reserve Act created almost a century ago for the very reason that politician’s saw the wisdom in an independent, politically bias free Fed making monetary policy. While Powell has admitted to being a republican, he has now shown his lack of independence in both republican and democratic administrations. It seems Powell is more concerned with just staying Fed chair and being renominated than any political ideology, or Fed independence.

Long term a lack of political independence damages the Fed’s credibility, and much of Fed policy is not actual policy actions, but guidance which depends on credibility. I don’t have kids so I can’t say that I’m concerned about my children’s future, but I have a lot of friends with kids that I love and I can say that I’m concerned about their future. I’m concerned about the future of our country. You don’t defeat 9.1% inflation with a 2.5% Fed funds rate, you just don’t.

I know that was a long-winded rant and you may be wondering where that came from and what does it matter with regard to market analysis in the short term. Well it has to do more with the future of our country in the long term but there’s definitely going to be an influence between now and September and while not an explicit dovish pivot by the Fed, it was as close as Powell could come without saying he had abandoned the fight against inflation. Heck, I don’t want to see my income burned through from inflation. Jen and I just went to our favorite restaurant and bar to listen to our favorite band we used to go see every Wednesday night and we looked at the menu, there were no more $1 chicken wings, but 5 wings were $10. There was no more $6 Coronas, but no $8 Coronas. Fries were no longer $5, but $8 and we had to send them back twice. The waitress admitted that they got a new supplier for their fries, which were clearly subpar as I rarely send food back, and almost never twice. Everything on the menu was significantly more money than 2 months ago that we decided, “We’ll just eat at home and maybe order 1 drink” and go watch our favorite band on Wednesday. We literally had that conversation Wednesday night on the way home. Now imagine that we’re not the only ones. What happens to the waitstaffs’ income? What happens to the establishment’s income, and reputation for quality of food? This is just one small example of out everyday life.

If the Fed doesn’t do its job and kill inflation, this time next year I expect I’ll see 5 chicken wings are $15 or $20…

…if the Fed is seen as truly having made a dovish pivot and weakening the fight against inflation (especially for political reasons), then that’s not a hard thing to imagine. Would it be more bullish for the equity market in the near term? Probably so. Would it create a situation in which inflation could become resurgent and force a whole new tightening cycle to finish the job that the Fed half-heartedly took on in the first place. Yes, and that wouldn’t be good for the longer term market and economy.

I hope you took everything I said above as neutral as possible. I’m not making a political statement, that’s not my job. It’s my job to give it to you straight and what I saw from Fed chair Powell this week, for the second time since he’s headed the Fed, is extremely concerning.”