Market Update

11:20 a.m. ET

It’s still a mixed market between what have been the weakest sectors, and the defensive sectors outperforming. All sectors that were in bear flags Friday (defensive sectors and Health Care were not) have either started breaking below, or are still in bear flags. For instance, Technology is showing relative strength this morning, but….

Technology sector (5m) still in the bear flag with a bearish near term bias.

The same applies for all of the major averages with small caps having dipped below already.

IWM (2m) I didn’t expect the decline from Friday’s small bear flag to be a waterfall sell-off, but rather more along the lines of a pull back. IWM has found some initial support at the top-end of the range identified last week around $111, and bounced, but in a small bear flag which may back-test the bottom trend line of Friday’s larger flag.

SP-500 (2m) while up 2.2%, it still trades in Friday’s bear flag right around $2600 where we saw resistance last week. S&P’s measured move is currently around $2450.

NASDAQ 100 outperforms today, but also in the bear flag from Friday. Dow is more like IWM having already dropped below and trading below still.

Macro signals are mixed with crude oil and 10-30 year yields the worst, and I mean bad.

USO (5m) since breaking last week’s rebound/consolidation, crude has been moving down in small bear flags of about 8% declines each.

USO (5m) since breaking last week’s rebound/consolidation, crude has been moving down in small bear flags of about 8% declines each.

The 10-year yield is down 12 basis points.

SP-500 and 10-year yield (1m) yields are tracking crude and leading the S&P lower.

On the positive side as mentioned since last week, AUD/USD is not heading lower, but rather continuing the bounce from last week. And Credit markets, which rallied strongly last week, look pretty good since the Fed’s bailout of everything.

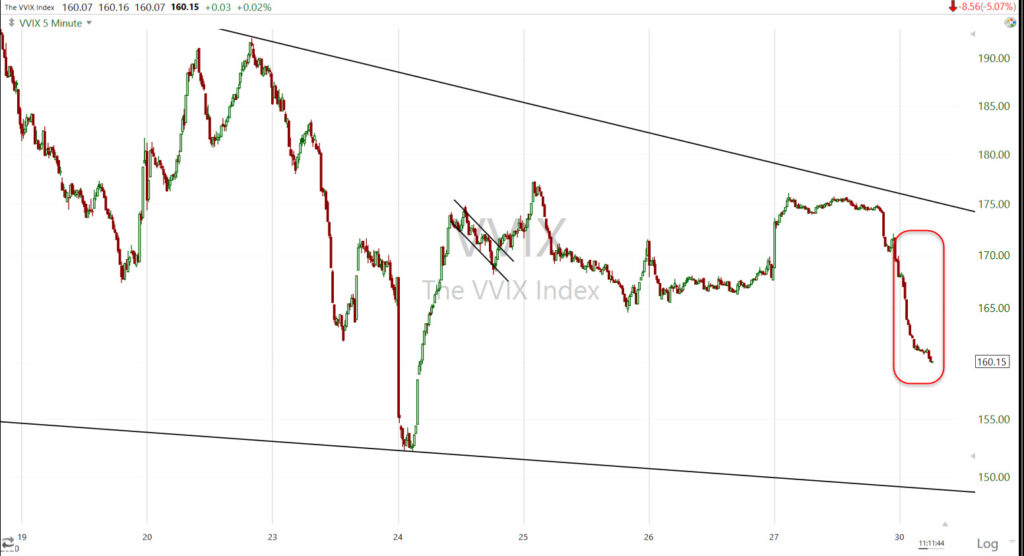

Intraday, volatility being relatively weak is helping the major averages. Keep an eye on VVIX, it’s moving more than VIX and thus far leading VIX.

VVIX (5m) has been a one-way street lower since the open. If volatility starts showing some strength, then I expect the averages start moving down toward their lower bear flag targets.

VVIX (5m) has been a one-way street lower since the open. If volatility starts showing some strength, then I expect the averages start moving down toward their lower bear flag targets.

The price action is still short-term bearish. I don’t expect the bottom to drop out below the averages, rather more along the lines of a low-volatility decline or pull back. However, if AUD/USD and credit weakens and starts moving along the lines of crude and yields, than I would change that outlook to a more severe decline.