Some Excerpts From Tonight’s Subscriber’s Post… Trouble Is Brewing For The Soft Landing

***These are “some” excerpts from tonight’s subscribers post.

All of the major indices closed lower and at or near their worst levels of the day on heavy volume.

The first half of the day Mega cap losses were having an outsized impact on index performance while the “rest” of the market held up okay. The early underperformance of mega cap stocks was a reaction to earnings results from Alphabet (GOOG -7.4%) and Microsoft (MSFT -2.7%), which did not live up to the market’s sky high expectations. Dow component Boeing (BA +5.3%) was another standout after its earnings report, but it traded higher after its results.

The afternoon got uglier with the FOMC and Powell presser which, despite market hopes, was hawkish from the outset of the policy statement.

The FOMC committee voted unanimously to leave the target range for the fed funds rate unchanged at 5.25-5.50%, as was expected, but the market was hoping for dovish rhetoric around the Fed’s rate cut path. Instead, the directive declared that, “The Committee does not expect it will be appropriate to reduce the target range until it has gained greater confidence that inflation is moving sustainably toward 2 percent.”

Powell reiterated this view in his press conference. Powell spoke specifically about the possibility of a March rate cut, saying in part “I don’t think it is likely that the Committee will reach a level of confidence by the time of the March meeting to identify March at as the time to do that (cut rates), but that is to be seen.”

On the market belief of a “soft landing”, averting a recession, which is extremely unlikely from a historical probabilities viewpoint, Powell acknowledged that he does not believe a soft landing has been achieved, saying in part “We are not declaring victory at all at this point. We think we have a ways to go.”

The S&P and NASDAQ were weak due to mega-cap weakness. The Dow did better as it doesn’t have the same cap-weighted exposure to the mega-caps, but Dow Transports (-1.65%) were down twice as much, and as suspected yesterday, broke down from their congestion zone. Small Caps, however, were the worst performer.

S&P-500 ⇩ -1.61 %

NASDAQ ⇩ -1.94 %

DOW JONES ⇩ -0.82 %

RUSSELL 2000 ⇩ -2.45 %

SP-500 (5m) That’s a near perfect intraday bear flag and 2 near equal legs down. The volatility around the end of the flag was the market initially getting bullish on a passing phrase from Powell that he had confidence in inflation comin down, but then fading the move as Powell made clear that a rate cut in March is not likely.

SP-500 (5m) That’s a near perfect intraday bear flag and 2 near equal legs down. The volatility around the end of the flag was the market initially getting bullish on a passing phrase from Powell that he had confidence in inflation comin down, but then fading the move as Powell made clear that a rate cut in March is not likely.

The S&P’s new record high is in danger of failing…

SPX (daily) the 2021 record high is just 1% lower and today’s price candle was very ugly.

SPX (daily) the 2021 record high is just 1% lower and today’s price candle was very ugly.

And as has been the case for 7 weeks, price fell on heavy volume, whereas price gains have been on light volume.

SPY (daily) weak price/volume trend since mid-December.

SPY (daily) weak price/volume trend since mid-December.

If the S&P breaks below the 2021 record highs, then it’s pretty likely we’re looking at a big double top from late 2021/early 2022 highs to present…

VIX (daily) – the S&P has been making higher highs over this period (yellow), VIX should have been making lower lows. I’ve seen this happen with VIX several times at important market tops such as the 2007-2008 top leading into the Financial Crisis. Late 2017 also comes to mind as the market was in full melt-up move, but VIX was rising with it and the market crashed into early 2018.

VIX (daily) – the S&P has been making higher highs over this period (yellow), VIX should have been making lower lows. I’ve seen this happen with VIX several times at important market tops such as the 2007-2008 top leading into the Financial Crisis. Late 2017 also comes to mind as the market was in full melt-up move, but VIX was rising with it and the market crashed into early 2018.

The mega-cap index (MGK -2.2%) underperformed the Equal Weight S&P (-1.3%) by 90 basis points. However, the Magnificent 7 mega-cap stocks collectively had their worst day since December 2022, which is exactly what I was talking about in last night’s Daily Wrap Mega-Caps Starting To Falter. And here’s the visual depiction of that happening…

SPX (2m) and the equal weighted basket of Mag-7 stocks (white) failing to make a higher high with the benchmark index, and really breaking down today.

SPX (2m) and the equal weighted basket of Mag-7 stocks (white) failing to make a higher high with the benchmark index, and really breaking down today.

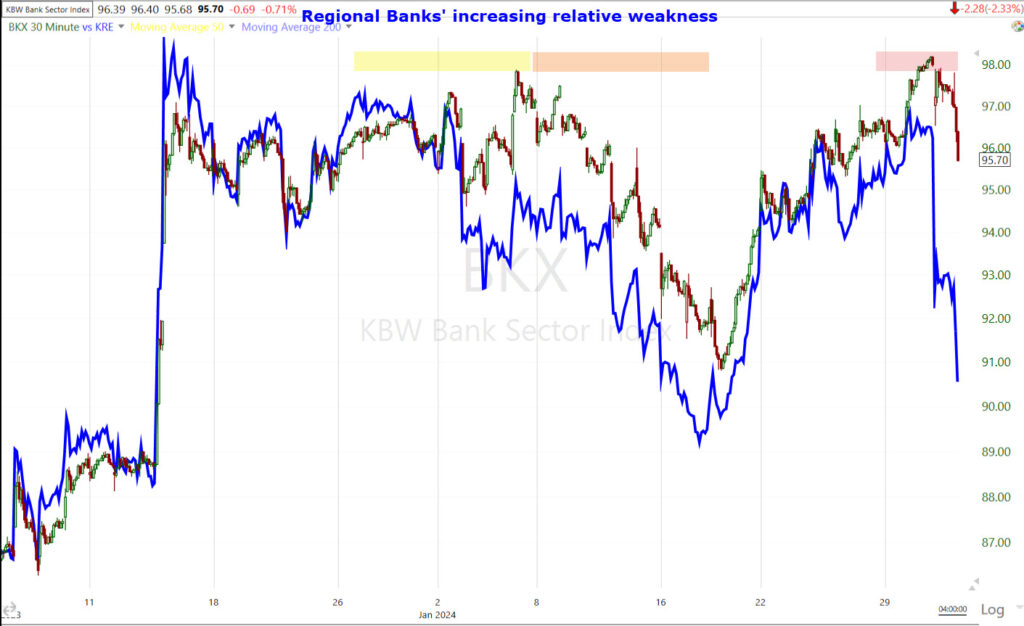

While everything was down today, there was another really ugly area today. There’s still huge underperformance in the Regional Banks (-5.85%) compared to the KBW Bank Index (-2.3%). New York Community bank was in the crosshairs after reporting (NYCB -37.7%). One of the red lines pulled from this statement compared to the prior was, “The U.S. banking system is sound and resilient.” And this is before the Fed has even pulled the March 11th plug on the BTFP facility.

KBW Bank Index (30m) and Regional Banks

KBW Bank Index (30m) and Regional Banks

Tonight I have the NASDAQ Composite’s Advance/Decline line for you, showing building weakness in market breadth/participation shortly after the S&P crossed above $4600, and certainly right into the start of the new year.

That just so happens to be the same area where breadth momentum indicators collapse.

Zweig Breadth Thrust negatively divergent as the S&P crosses above $4600 and into the new year.

Zweig Breadth Thrust negatively divergent as the S&P crosses above $4600 and into the new year.

McClellan Oscillator (15m) like the ZBT, positively divergent at the October market low, negatively divergent as SPX crosses above $4600 and into the new year.

McClellan Oscillator (15m) like the ZBT, positively divergent at the October market low, negatively divergent as SPX crosses above $4600 and into the new year.

SPX (30m) and HYG’s lower highs and lack of confirmation of the S&P’s record high. It look s likely that the record high will be short-lived, and ultimately a failed new high.

SPX (30m) and HYG’s lower highs and lack of confirmation of the S&P’s record high. It look s likely that the record high will be short-lived, and ultimately a failed new high.

From here I’m looking for the SPX’s record high to likely fail, which sets up an even larger bull trap from $4600, which is where 3C’s “Jaws of Death” divergence began. It never stopped either.

SPY (30m) and 3C negatively diverging, lacking underlying money-flow support from $4600 and the new year.

SPY (30m) and 3C negatively diverging, lacking underlying money-flow support from $4600 and the new year.

As I said in the New Year forecast video of early January, I think 2024 is going to surprise and catch a lot of investors off-guard. And as I’ve been writing recently, I don’t recall (of the top of my head) a recent incidence in which we entered a bear market or crash that wasn’t from an all-time record high. Some examples: the Dot.com bubble bursting, the Great Financial Crisis, 2016’s mini-bear market, early 2018’s crash and Oct-December 2018’s near bear market, and then the Covid Crash – all came off what were at the time, new record highs.

Get these daily insights and much more by joining our tribe. Subscribe HERE before subscription rates increase with the launch of The Technical Take (and our Discord room).