Stock Market Daily Wrap January 26, 2021

The overnight session was volatile with index futures initially dropping after Asian stocks saw their biggest slide in 2 months after the PBoC drained liquidity (cash) from the financial system ($78 billion yuan) after a PBoC adviser warned that bubbles have formed in the stock and property markets, and he proposed a shift in monetary policy. “Whether this situation will intensify in the future depends on whether monetary policy is appropriately changed this year,” he said. He added that if not, such problems would “certainly continue” and lead to “greater economic and financial risks in the medium- and long-term.”

Index futures retraced losses and gained during the European session.

The S&P closed lower after hitting an all-time high shortly after the open, but more interestingly was Small Cap’s early strength, up +0.9% with cyclicals like Energy and Industrials leading, all of which faded shortly after the open. Energy went from the best performing shortly after the open, up +2.4% in what seemed like a technical bounce at best with little conviction, to the worst performing shortly after.

From the Early Update –

“In short, many of the cyclical sectors that have been weak the past 2 weeks are trying to bounce from areas they need to bounce from or else risk more serious technical damage, but so far there doesn’t seem to be a whole lot of excitement to do anything more than the bare minimum.”

Market dynamics remained consistent with those in recent weeks, value/cyclical stocks underperformed, while mega-cap stocks provided influential support.

Averages

The averages finished mixed, but very little changed, except Small Cap Russell 2000’s underperformance. The mega-caps outperformance (generally +1% to +1.5%) provided influential support and offset cyclical weakness. The S&P equal weight index (stripping out mega-caps influential weight) ended lower by -0.5%. NASDAQ-100’s equal weight index finished lower by -0.5%.

S&P 500 ⇩ -0.15 %

NASDAQ ⇧ 0.05 %

DOW JONES ⇩ -0.07 %

RUSSELL 2000 ⇩ -0.62 %

Dow Transports underperformed Dow Industrials, down -1.6%, nearing the 50-day moving average.

S&P sectors

The defensive Real Estate, Consumer Staples, and mega-cap heavy Communications finished atop the standings with decent gains, while the cyclical Energy, Materials, Industrials and Financial sectors struggled in negative territory. Banks underperformed (-1.15% to -1.4%).

Materials ⇩ -1.38 %

Energy ⇩ -2.14 %

Financials ⇩ -0.80 %

Industrial ⇩ -0.92 %

Technology ⇧ 0.07 %

Consumer Staples ⇧ 0.90 %

Utilities ⇩ -1.00 %

Health Care ⇩ -0.37 %

Consumer Discretionary ⇩ -0.06 %

Real Estate ⇧ 1.02 %

Communications ⇧ 1.36 %

Summarizing the recent changes in character from inflationary or reflationary value over growth, to the more recent deflationary secular growth over cyclicals/value in a few sector charts…

Cyclicals/Value…

Materials sector (60m) since the Pfizer vaccine news…

Materials sector (60m) since the Pfizer vaccine news…

Energy sector (30m) rejected this morning (red) above former key support, now resistance.

Energy sector (30m) rejected this morning (red) above former key support, now resistance.

Regional Banks (15m) trading to the bottom of (and just below) their channel

Regional Banks (15m) trading to the bottom of (and just below) their channel

Industrial sector (30m) coming to a key support trend line again after a failure to breakout above the former triangle’s apex.

Industrial sector (30m) coming to a key support trend line again after a failure to breakout above the former triangle’s apex.

Defensive Bond prox sectors…

Consumer Staples (60m) were out of favor as cyclicals/value rallied, but have recently made a come back as bonds have gained.

Consumer Staples (60m) were out of favor as cyclicals/value rallied, but have recently made a come back as bonds have gained.

Mega-cap heavy sectors like Communications (30m) did little while cyclicals rallied and even started fading fast, but have since rebounded due to their relatively safer secular growth.

Mega-cap heavy sectors like Communications (30m) did little while cyclicals rallied and even started fading fast, but have since rebounded due to their relatively safer secular growth.

This is why I say that we haven’t seen a definitive break down in the cyclical/value/reflationary trade, but it’s certainly on the edge in many cases.

Internals

NYSE Decliners (1852) outpaced Advancers (1283) on slightly lower Volume of 1.1 bln shares.

There is no Dominant price/volume relationship and n 1-day oversold condition.

*NYSE 52 week new lows jumped to the highest in nearly 12 weeks today.

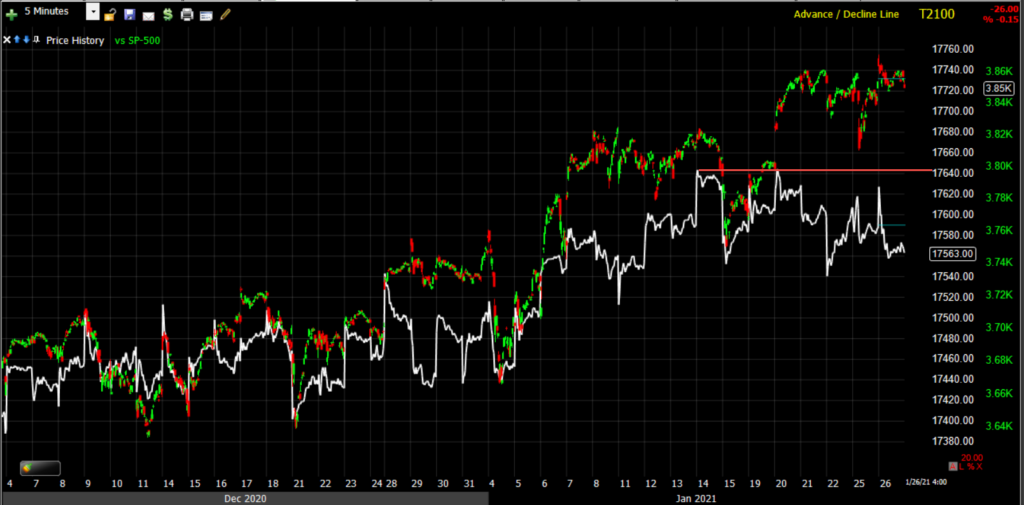

As I pointed out last week, Advance/Decline lines did not confirm last week’s gains.

SP-500 (5m) and NYSE A/D line (white) did not make a higher high with the S&P.

The Absolute Breadth Index finished at 16, moving lower toward the extreme low and VIX long signal under 14.

Treasuries

U.S. Treasuries finished little changed in a calm session. The 2-year yield was flat at 0.12%, and the 10-year yield was flat at 1.04%.

Currencies and Commodities

The U.S. Dollar Index fell -0.3% to 90.14. The Dollar remains in consolidation (bullish near term bias) above the 10 week downtrend.

WTI crude futures fell a modest -0.3% to $52.62/bbl. in a 2 week consolidation/correction.

Gold finished modestly lower for the fourth session, down -0.2% to $1,850.90/oz. The last 2 weeks gold has more or less traded sideways.

Bitcoin and GBTC (-4.73%) look more constructive in large bull flags or bullish wedges. I have no problem or concerns with these larger consolidations after a 100% advance. In fact I think they’ll provide a much more attractive price point for new long entries, or add-to long positions.

BTC/USD (4h) falling volume during the consolidation is constructive.

BTC/USD (4h) falling volume during the consolidation is constructive.

GBTC (60m) I’d consider an add-to purchase near the lower trend line ($28-$29 area).

GBTC (60m) I’d consider an add-to purchase near the lower trend line ($28-$29 area).

Summary

While the major averages were very little changed, the main development was the attempted bounce of small caps and cyclicals after nearly 2 weeks of underperformance. The last 2 weeks have seen a shift from inflationary or re-flationary leadership, back toward deflationary dynamics. The bond market saw a change in tone away from reflation about 2 weeks ago, but hadn’t made a definitive move since, but yesterday’s 5 bp drop in the 10-year was a wake up call. It’s still not a definitive change in trend, but something to keep an eye on. Tomorrow’s FOMC could certainly shake things up.

It seems that new coronavirus variants that sparked fresh lockdowns and other restrictions are weighing on the reflation trade that bets on an end to curbs. Investors are also concerned about the vaccine rollout and are seeking more clarity on the timeline for President Joe Biden’s $1.9 trillion Covid-19 relief plan with many Wall Street banks expecting a package much smaller around $1.1 bln, Goldman expects even less around $900 mln.

Overnight

In afterhours strong earnings from Microsoft Corp. (+4.95%) boosted Nasdaq futures (+0.45%). S&P (0%), Dow (0.05%) and Russell 2000 (-0.15%) are little changed.

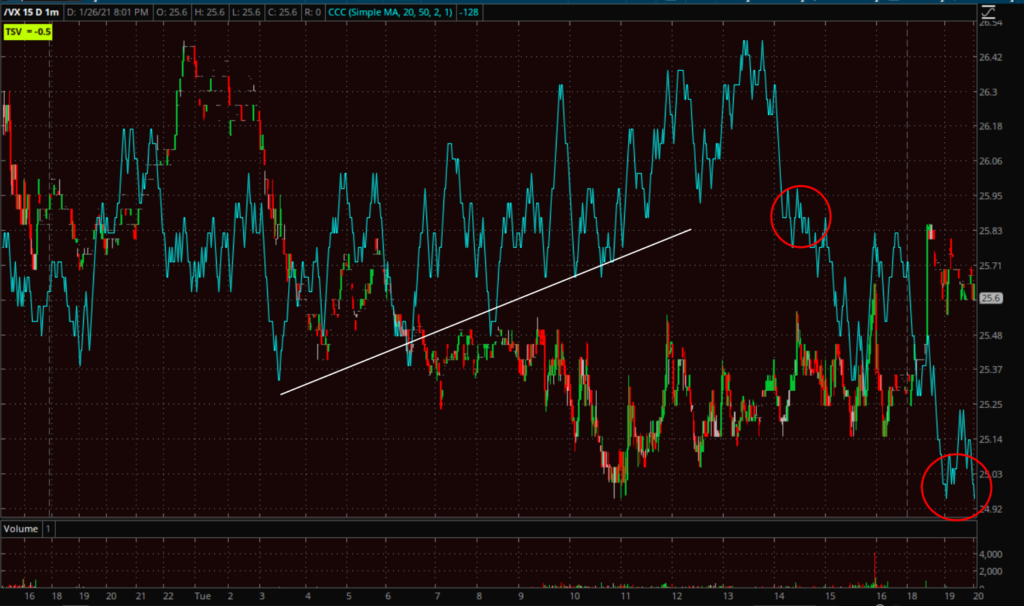

Volatility tends to come under downside selling pressure 24 hours ahead of major Fed events like tomorrow’s FOMC at 2 p.m. and that’s apparent in VIX futures (+0.95%) starting around 2 p.m. ET.

VIX futures (1m) selling pressure late this afternoon and tonight.

VIX futures (1m) selling pressure late this afternoon and tonight.

For this reason stocks tend to drift gently upward into the FOMC at 2 p.m., after that it’s anyone’s guess. More broadly, however, there has been substantial improvement in VIX futures since last week.

VIX futures (2m) positive divergence.

VIX futures (2m) positive divergence.

Looking ahead, investors will receive Durable Goods Orders for December and the weekly MBA Mortgage Applications Index on Wednesday.

Apple, Tesla, Facebook and Samsung Electronics Co. are among companies reporting results.

The Federal Open Market Committee monetary policy decision (2 p.m. ET) and briefing by Chair Jerome Powell (2:30 p.m. ET) are scheduled for Wednesday. As always, beware of initial knee-jerk reactions. They are often noise and faded. I’ll e watching how volatility and its 3C charts act after the FOMC and Powell’s presser, as well as watching the Absolute Breadth Index for any plunge below 14. The lower, the more appealing it will be to add to my long volatility position (VXX Feb 19th $17 Call

Fourth-quarter GDP, initial jobless claims and new home sales are among U.S. data releases Thursday.

U.S. personal income, spending and pending home sales come Friday.