Things Are Getting Serious Fast – Emergency Fed Rate Cut?

I’m trying to get this post out fast, some of the price-percent changes may have changed as things are moving fast, but that’s not what’s important. In the wake of China’s retaliation, imposing an extra 34% tariff on US goods today, things are getting very serious very fast.

Looking around at futures, more signals of recession. WTI Crude is down -9%. That’s about -14%-15% in 4 days. There’s no rule of thumb with this, but in the past I have seen Crude oil drop in the 20% range over a short period of time and it’s always been a warning of a recession or a market crash. The primary difference is most times I’ve seen it in the past, the stock market was still trading at all time highs, ignoring the signal, and then sold off, whereas the market is selling off in real-time to real-time developments.

Here’s Oil prices crashing -20% week ahead of the stock market in 2020.

The S&P’s -35% crash doesn’t look so bad here because the chart is normalized and recall oil futures prices actually went negative at one point. Yes, you could get paid to take oil for delivery if you were able to store it. That’s not important, it’s the signal it sent WELL before stocks ever got the message, starting the second week of January 2020. Stocks started cracking February 21st.

The S&P’s -35% crash doesn’t look so bad here because the chart is normalized and recall oil futures prices actually went negative at one point. Yes, you could get paid to take oil for delivery if you were able to store it. That’s not important, it’s the signal it sent WELL before stocks ever got the message, starting the second week of January 2020. Stocks started cracking February 21st.

Copper futures are another I’ve long used as a leading economic signal, whether it be signaling inflation, which it did an amazing job of probably a year ahead of the Fed actually doing something about inflation because they were still calling it, “transitory.”

I’ve seen Copper signal deflationary events as well (recession), such as before the Covid crash – again when stock markets were missing the message and trading at record highs. Copper cracked some 13% lower 3 weeks ahead of the stock market crash of 2020. Copper is down-9% this morning and roughly 15% over the last week and a half.

Covid Crash – Copper called it well before stocks got the message.

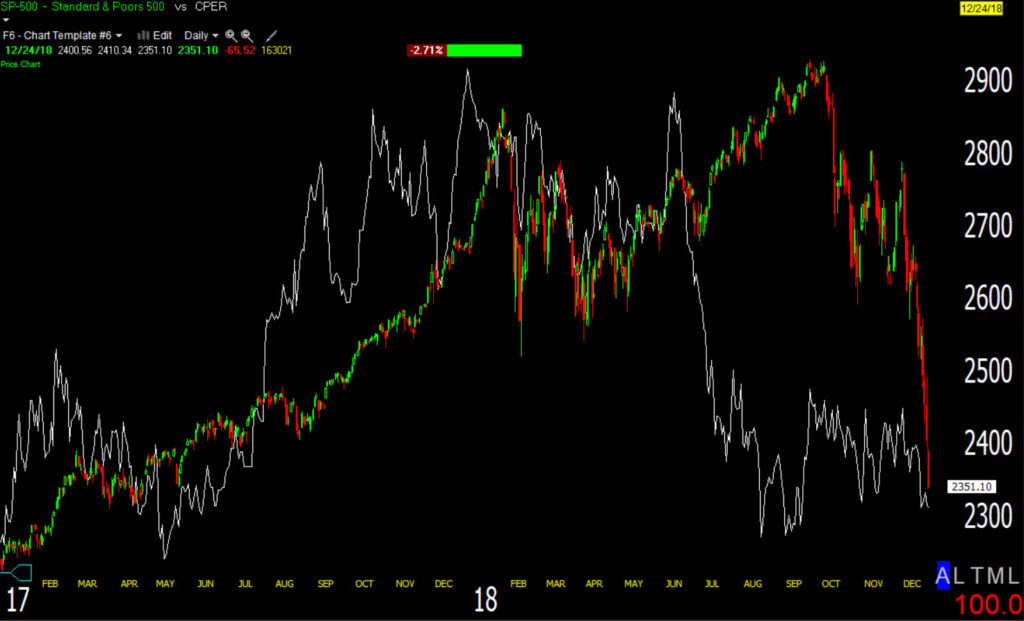

Here’s Copper calling the 2018 market crash of 20% for the SPX starting back in June through August. The stock market got the message in early October.

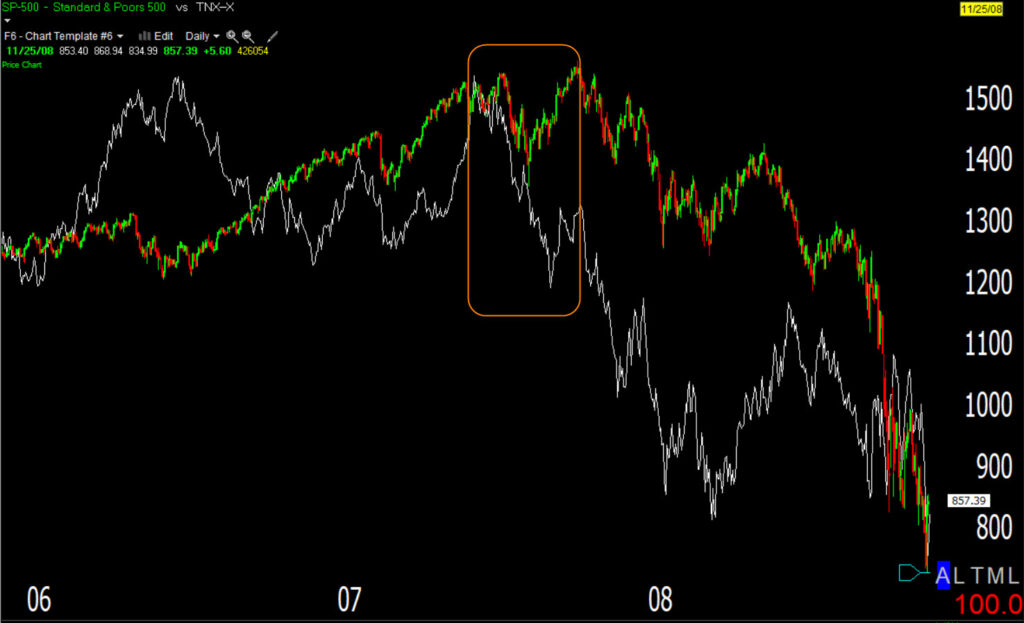

The Rates market is a strong leading signal, whether inflation or deflation (read as recession in this case). The 10-yr yield came down about 40 basis points from June to October of 2007 when the stock market hit its all-time high just ahead of what would become the Great Financial Crisis.

Yields did it again ahead of the Covid Crash. In fact it was yields, Crude, Copper and the Australian Dollar (commodity currency) that had me pounding the table 5 weeks ahead of the Covid crash that other, larger and more sophisticated asset classes were screaming, “Major deflationary event just ahead”

SPX and 10 and 30-yr yields.

They called inflation being more than transitory, too. The 10-yr yield is down 45 points since March 27th, sending the same message.

In the latest news on China tariffs, President Trump responded on Truth Social.

It’s looking like we’re headed to my SPX measured move of (subscriber information).

There’s going to be a bumpy ride with whatever the Trump administration decides to do. This puts the Fed in a bad spot, but the one thing that that trumps (no pun intended, seriously) their concerns about reigniting inflation with a rate cut to stave off an economic slowdown, is disorderly markets represented by credit markets cracking and we’re seeing signs of that. If the plumbing of the monetary system collapses, it doesn’t matter what the Fed does, their policy can’t be transmitted.

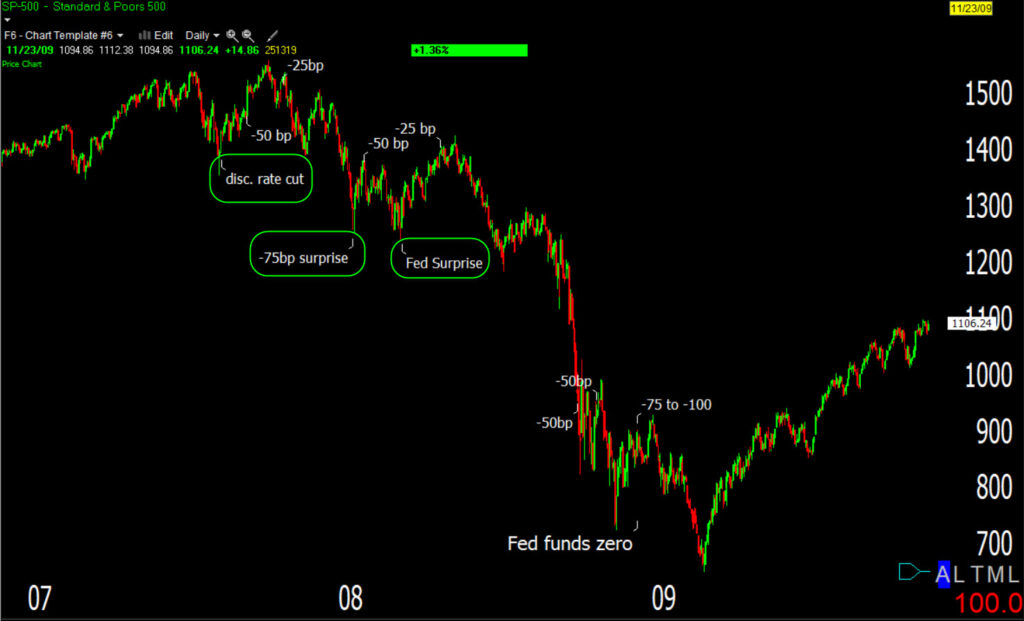

Typically the market will rally sharply on a Fed Emergency Rate cut. I can show you examples of this going back to the 1929 crash. The key is they have to go big enough relative to what the market is demanding, which we can track via futures. It took them a couple of shots to get it right in 1929, but these days the Fed typically responds strongly and quickly. They learned that lesson.

DJIA (1928-1930) with Fed policy decisions during the 1929 crash.

In fact, most bear market counter-trend rallies have their origination in “surprise” Fed policy moves, or emergency intermeeting moves. Here are some examples from the Great Financial Crisis.

SPX Great Financial Crisis – Remember that I said, counter-trend rallies. These are counter trend to the prevailing downtrend. That doesn’t mean the Fed can head off a bear market or recession, but counter trend rallies are some of the biggest, fastest and strongest you’ll see in any market. Typically they are much stronger than rallies in a bull market over the same time period.

SPX Great Financial Crisis – Remember that I said, counter-trend rallies. These are counter trend to the prevailing downtrend. That doesn’t mean the Fed can head off a bear market or recession, but counter trend rallies are some of the biggest, fastest and strongest you’ll see in any market. Typically they are much stronger than rallies in a bull market over the same time period.

Remember earlier this week in Monday’s Daily Wrap I started the post with,

“Stagflation seems to be the theme with just about all of the economic data coming in. That ties the Fed hands unless an economic slowdown/recession becomes a much larger threat than inflation. Ever since the entire inflation episode kicked off several years ago, I haven’t once felt there was a credible probability of the kind of inflationary resurgence of the late 1970’s/early 1980’s. While I still don’t think it’s a high probability, this is the first time I can see a credible path to the scenario. “

This is the kind of scenario I had in mind. Things escalate so badly that the Fed is forced to ignore inflation risks and step in to prevent a widespread economic crisis, and in doing so, reignites inflation.

Late last year I wrote dozens and dozens of times that 2025 was going to be a much more interesting year.