Tuesday Morning Update

Good morning and welcome back from the Martin Luther King holiday.

After signs of risk appetite waning on Friday, despite quite a bit of good news that could have sparked better follow through from Thursday’s gains (i.e.-Housing Starts rose to their highest level in 13 years in December and China’s industrial production rose more than expected in December), the benchmark averages closed out the week strong, but as noted in Friday’s Afternoon Update, Small Caps deteriorated along with credit-related leading indicators, failing to follow through on a strong and seemingly liquidity-driven (Fed repo?) rally from Thursday.

A bout of risk aversion took hold overnight in the Asian session as Chinese authorities confirmed that the coronavirus can be spread by human-to-human contact, and the deadly disease is spreading to other Asian nations. Dow futures plunged by more than 100 points late Monday night as the news prompted fears of a SARS2.0 epidemic and related economic damage done by the SARS virus in 2002-2003, particularly given the threat of contagion as hundreds of millions travel for the Lunar New Year holidays.

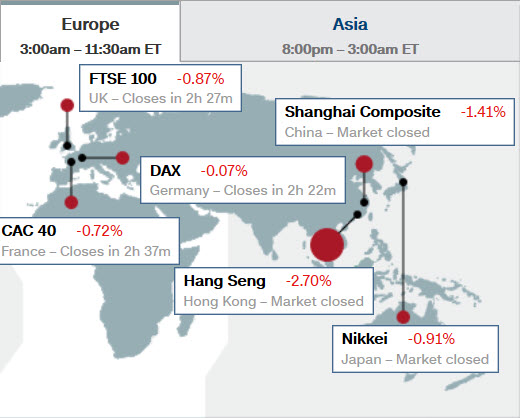

China’s Shanghai Composite fell -1.4% on Tuesday amid concerns about its impact on economic activity, while Hong Kong’s Hang Seng fell -2.8% as the region was further pressured by a Moody’s credit downgrade.

In other news, President Trump has kicked off the World Economic Forum in Davis, Switzerland with a speech touting the U.S. economy and the trade deal with China.

Earnings season will continue to be in focus this week. In pre-market:

- Delta Air Lines (DAL): -1.7% on concerns that the coronavirus could slow down tourism.

- Halliburton (HAL): +0.4% after beating earnings estimates.

- UBS (UBS): -4.2% after the Swiss investment bank lowered its guidance, although it did beat earnings estimates.

Global market snapshot…

Moody’s lowered Hong Kong’s rating to Aa3 from Aa2 due to “weaker institutional capacity.” The Bank of Japan left its interest rate on excess reserves at -0.10% but increased its FY20 growth forecast to 0.9% from 0.7%. The rate decision comes ahead of the ECB’s later this week and the Fed’s next week. On a related note, the IMF lowered its global growth forecast for 2020 to 3.3% from 3.4%.

- Japan’s November Industrial Production -1.0% m/m (expected -0.9%; last -4.5%) and Capacity Utilization -0.3% m/m (expected -0.7%; last -4.5%)

- South Korea’s December PPI 0.3% m/m (expected -0.1%; last -0.1%); 0.7% yr/yr (expected 0.2%; last -0.1%)

- Hong Kong’s December Unemployment Rate 3.3% (expected 3.2%; last 3.2%). December CPI 2.9% yr/yr (expected 3.0%; last 3.0%)

The European Central Bank’s lending survey for Q4 showed that lending standards were unchanged during the quarter and they are expected to remain stable in Q1. The World Economic Forum began in Davos today.

- Eurozone’s January ZEW Economic Sentiment 25.6 (expected 5.5; last 11.2)

- Germany’s January ZEW Economic Sentiment 26.7 (expected 15.0; last 10.7) and ZEW Current Conditions -9.5 (expected -13.5; last -19.9)

- U.K.’s November Average Earnings Index + Bonus 3.2% yr/yr (expected 3.1%; last 3.2%). November Unemployment Rate 3.8%, as expected (last 3.8%)

- Spain’s November trade deficit EUR1.86 bln (last deficit of EUR2.58 bln)

S&P 500 sector standings this month shows the FAANG-heavy Technology (+5.9%) and Communications (+5.2%) sectors leading. Conversely, the Energy (-1.7%) and Materials (-0.5%) sectors are the lone groups in negative territory. Interestingly given last week’s risk on bias, the defensive Utilities sector (+3.65%) was the week’s best performer, Energy (-1.15%) the sole decliner.

S&P futures are down -0.3% and about -0.5% fair value. S&P futures found some local support around $3307.

S&P futures (2m) were ramped Friday afternoon into the close for a solid end of the week, but Russell 2000 (Small caps) closed with a bearish dark cloud cover candlestick Friday. Monday night’s coronavirus news caused a bout of risk aversion.

The news last night that the coronavirus can be spread by human-to-human contact sparked a bid in safe haven assets from Gold, to the safe-haven Japanese Yen and U.S. Treasuries, but Volatility still looks relatively subdued after last week’s concerted selling effort starting Tuesday. VIX futures are up +1.7% this morning, but 3C charts still look fairly soft.

U.S. Treasuries have seen more of a safe-haven bid, higher this morning pushing yields lower in a curve-flattening trade. The 2-year yield is down three basis point to 1.54%, and the 10-year yield is down five basis points to 1.79%. Beyond the general risk aversion as seen in Treasuries this morning, remember that the Financial sector has been trading in a 5 week rectangle consolidation with the higher beta, more growth sensitive Regional Banks leading lower. The yield curve flattening will be a headwind for the sector that kicked off earnings season last week.

The U.S. Dollar Index is down 0.15% to 97.43.

WTI crude is down -0.6% to $58.20/bbl.

Crude does not look as at risk for the second leg down (additional -5%), but it did not hold above $59 last week, which I believe is a key level to invalidate the bearish consolidation following an -8% decline after the Soleimani assassination (Iran geopolitical tensions).

Gold futures are down -0.6% to $1551, failing to hold Monday’s safe-haven bid.

Overall there’s a risk averse tone this morning as depicted by the safe haven bid and curve flattening in U.S. Treasuries, it hasn’t escalated into panicky conditions. Remember that small caps and credit related issues showed a weakening tone well before the news on Friday. I expect we’ll see a morning effort to fill some of the opening gap that we’re set to post. We’ll see what things look like at that point after the cash open.