A.M. Update

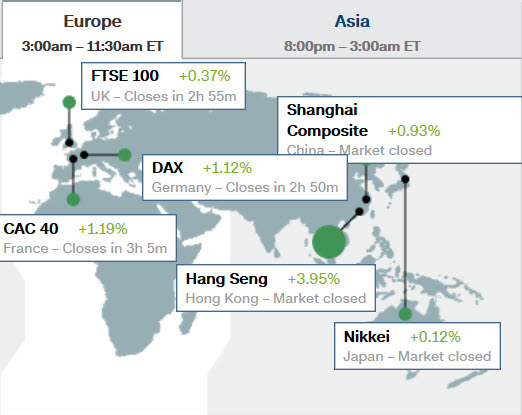

U.S. equity futures have rebounded from yesterday’s decline as the market reacts positively to global political developments in Hong Kong and the U.K.

Hong Kong’s Chief Executive, Carrie Lam, said that the extradition bill that sparked months of protests will be fully withdrawn. Activist Joshua Wong described the action as, “too little, too late.” Hong Kong’s Hang Seng rose 3.9% on Wednesday.

The pound has rallied against the dollar after the government lost control of the Brexit process during yesterday’s vote. The British Parliament took a step closer to passing legislation to delay a no-deal Brexit on Oct. 31. Prime Minister, Boris Johnson, has proposed a snap election for October 15, however it may be unlikely to succeed according to The Wall Street Journal.

A number of Fed officials are slated to speak today. Speakers will include New York Fed President Williams (FOMC voter) at 9:30 a.m. ET, Dallas Fed President Kaplan (alternate voter) at 10:00 a.m. ET, Fed Governor Bowman (FOMC voter) at 12:30 p.m. ET, St. Louis Fed President Bullard (FOMC voter) at 12:30 p.m. ET, Minneapolis Fed President Kashkari (alternate voter) at 1:00 p.m. ET, and Chicago Fed President Evans (FOMC voter) at 3:15 p.m. ET.

Global markets…

- China’s August Caixin Services PMI 52.1 (last 51.6)

- Japan’s August Services PMI 53.3 (expected 53.4; last 52.3)

- Hong Kong’s August Manufacturing PMI 40.8 (last 43.8)

- Australia’s Q2 GDP +0.5% qtr/qtr, as expected (last 0.5%); +1.4% yr/yr, as expected (last 1.8%). Q2 GDP Capital Expenditure -1.7% qtr/qtr (last -0.7%), Q2 Chain Price Index +1.2% qtr/qtr (last 1.3%), and Q2 GDP Final Consumption +1.0% qtr/qtr (last 0.4%). August Services PMI 49.1 (expected 49.2; last 52.3) and August AIG Services Index 51.4 (last 43.9)

- India’s August Nikkei Services PMI 52.4 (expected 51.9; last 53.8)

- Eurozone’s July Retail Sales -0.6% m/m, as expected (last 1.2%); +2.2% yr/yr (expected 2.0%; last 2.8%). August Services PMI 53.5 (expected 53.4; last 53.4)

- Germany’s August Services PMI 54.8 (expected 54.4; last 54.4)

- U.K.’s August Services PMI 50.6 (expected 51.0; last 51.4)

- France’s August Services PMI 53.4 (expected 53.3; last 53.3)

- Italy’s August Services PMI 50.6 (expected 51.6; last 51.7)

- Spain’s August Services PMI 54.3 (expected 53.0; last 52.9)

S&P futures are up +0.9%.

ES (1m) mostly in line overnight with some slight loss of confirmation this morning.

The U.S. Treasury yield curve has seen some steepening activity this morning. The 2-year yield is flat at 1.47%, and the 10-year yield is up two basis points to 1.49%.

2-Year Treasury futures (1m) in line

2-Year Treasury futures (1m) in line

Ultra T-Bond Futures (1m) negative divergence in to the high, positive divergence at the low.

Ultra T-Bond Futures (1m) negative divergence in to the high, positive divergence at the low.

The U.S. Dollar Index is down 0.4% to 98.65.

WTI crude is up 2% to $55/bbl.

Gold futures are down -0.5% to $1548.10

The short end of treasuries seems to be waiting on the Fed officials to speak to get some kind of clue of what to expect at the September FOMC. The long end has a positive divergence, also apparently waiting to see whether the good political news overnight is enough, or if the Fed may spoil the party. I suspect that’s why S&P futures’ 3C chart has gone from confirmation overnight, to less confirmation this morning.