A.M. Update

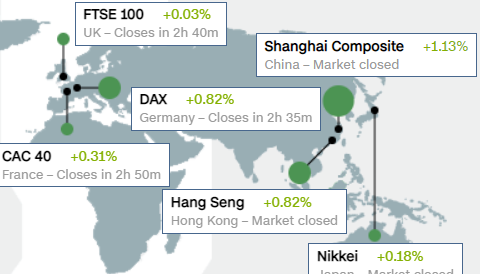

Investors woke up to an optimistic futures market apparently over a combination of a stimulus deal, vaccination efforts, and the Fed’s dovish monetary policy (as evidenced by a weak Dollar this morning). At the same time they’re looking past the headwinds of rising coronavirus cases, regional lockdowns, and weaker economic data.

On the latter point, the latest weekly initial jobless claims edged higher with the count totaling 885,000 (consensus 795,000). Today’s tally was above the prior week’s revised count of 862,000 (from 853,000). As for continuing claims, they decreased to 5.508 mln from a revised count of 5.781 mln (from 5.757 mln). Treasury futures gained on the disappointing data.

The Bank of England voted 9-0 to keep its bank rate and its purchase program at 0.10% and 875 billion pounds, respectively. The Swiss National Bank kept its policy rate at -0.75%, as expected. The U.S. Treasury labeled Switzerland a currency manipulator in a report released yesterday.

The European Parliament said that a Brexit deal must be completed by Sunday in order for the parliament to ratify the agreement by the end of the year.

South Korea’s Finance Ministry expects that the country’s 2020 GDP will contract 1.1% after the previous forecast called for slight growth of 0.1%. The growth forecast for 2021 was lowered to 3.2% from 3.6%.

- Australia’s November Employment Change 90,000 (expected 50,000; last 178,800) and Full Employment Change 84,200 (last 97,000). November Unemployment Rate 6.8% (expected 7.0%; last 7.0%) and November Participation Rate 66.1% (expected 66.0%; last 65.8%)

- New Zealand’s Q3 GDP 14.0% qtr/qtr (expected 13.5%; last -11.0%); 0.4% yr/yr (expected -1.3%; last -11.3%). Q3 GDP Expenditure 15.6% qtr/qtr (expected 12.5%; last -9.5%)

- Singapore’s November trade surplus SGD3.93 bln (last surplus of SGD4.35 bln). November non-oil exports -4.9% yr/yr (expected 2.0%; last -3.1%). Q4 Unemployment Rate 3.6%, as expected (last 2.8%)

- Hong Kong’s November Unemployment Rate 6.3% (last 6.4%)

French President Macron will self-isolate after testing positive for the coronavirus. Several other European leaders will also self-isolate after meeting with the French president in recent days.

- Eurozone’s November CPI -0.3% m/m, as expected (last 0.2%); -0.3% yr/yr, as expected (last -0.3%). November Core CPI -0.5% m/m (expected -0.3%; last 0.1%); 0.2% yr/yr (expected 0.2%; last 0.2%)

- France’s December Business Survey 93, as expected (last 92)

S&P futures are +0.4% at $3708. Dow and Russell 2000 futures display slight relative weakness.

VIX futures 3C chart continues to firm up and displays some price relative strength.

U.S. Treasuries gained on the disappointing Initial Claims data. The 2-year yield is flat at 0.12%, and the 10-year yield is down 2 bp to 0.90%.

The U.S. Dollar Index is trading below 90 with a 0.65% decline at 89.87.

WTI crude futures are up 0.85% to $48.43/bbl amid the weaker dollar.

Gold futures are up +1.9% to $1894/oz.

Bitcoin futures are the standout, up another +9.3% to $22,885

On least point of interest, the safe-haven Japanese Yen was bid all night, sending the Dollar-Yen lower, belo $10-3.50 (my risk-off line in the sand).

USD/JPY (60m) to a lower low, but more notably, has retraced the entirety (and then some) of the Pfizer vaccine news that sent stocks soaring on November 9th. Hmmm…

USD/JPY (60m) to a lower low, but more notably, has retraced the entirety (and then some) of the Pfizer vaccine news that sent stocks soaring on November 9th. Hmmm…