A.M. Update

Futures have been slowly pushing higher within the trend from yesterday’s cash session, but a few other divergent assets seen last night, like Treasuries, are also moving.

On the latest trade war “He said, she said”, an official from China’s Foreign Ministry said that there have been no recent phone calls between officials from China and the United States, pushing back against President Trump’s suggestion to the contrary. Not helping the credibility of the claim, the People’s Bank of China fixed the yuan at 7.0810 per dollar, representing the weakest fix since March 2008.

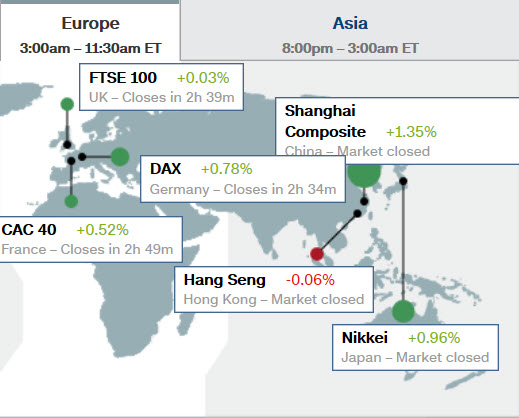

Global markets…

- China’s July Industrial Profit -1.7% ytd (last -2.4%); +2.6% yr/yr (last -3.1%)

- Japan’s July BoJ Core CPI +0.6% yr/yr (last 0.6%) and July Corporate Services Price Index +0.5% yr/yr (last 0.7%)

- South Korea’s August Consumer Confidence 92.5 (last 95.9).

- The People’s Bank of China fixed the yuan at 7.0810 per dollar, representing the weakest fix since March 2008.

- Germany’s Q2 GDP -0.1% qtr/qtr, as expected (last 0.4%); 0.0% yr/yr (expected 0.4%; last 0.7%)

- U.K.’s July Gross Mortgage Approvals 43,300 (last 42,800)

- France’s August Business Survey 102 (expected 101; last 101) and August Consumer Confidence 102, as expected (last 102)

- Germany’s Economy Minister, Peter Altmeier, said that trade talks between officials from the EU and the U.S. will be difficult, but the global slowdown increases chances of an agreement being reached.

Futures are currently trading near their best levels of the morning in what has been a calm pre-market session. S&P futures +0.35%. However, there is a negative divergence developing this morning.

ES (1m) overnight

Likewise, VIX futures are down, but with a positive divergence developing this morning. The market smells some risk out there, perhaps China disputing the detente in the trade war (phone call). Still the divergences are early and small.

Safe haven assets that showed a positive divergence early last night, like the Japanese yen, where bid up in the overnight session. It has since stabilized in to the cash open.

Also some U.S. Treasuries showed a positive divergence last night, and edged higher since, pushing yields lower in a curve-flattening trade. The 2-year yield is down two basis points to 1.53%, and the 10-year yield is down five basis points to 1.50% with a clear inversion of the 2s-10s for a fourth day.

The U.S. Dollar Index is down 0.2% to 97.90

WTI crude is up 1% to $54.18/bbl after Iran said the U.S. should first lift sanctions if it wants to hold a meeting, according to Bloomberg. Crude’s price is still trading in a consolidation after yesterday’s loss of gains in the cash session.

The averages are continuing the corrective bounce started yesterday and along the same trajectory as yesterday’s cash session, that’s pretty much expected. However, yields will open divergent vs. the S&P and there are some signs of safe havens and areas like VIX seeing underlying buying filtering in.

The bones of the whimper rally’s skeleton are being fleshed out.