Market Update-Yields leading small caps, small caps leading the broader market

Summarizing the session, yields lower and curves flattening are putting pressure on the Financial sector, specifically the more sensitive Regional Banks (KRE). Small Caps tend to be led by Regional Banks, which explains why IWM is the worst performer. In turn, small caps have led the broader market lower.

KRE just broke under last Friday’s low at $48.40 and is leading small caps lower.

IWM (2m) with KRE – last Friday’s low (red)

IWM (2m) with KRE – last Friday’s low (red)

The charts above and below are normalized as of Thursday around 11:30 a.m. ET.

In turn, small caps/IWM are leading the broader market lower…

QQQ (2m) and IWM (blue). Notice QQQ is still holding at support of yesterday’s consolidation. The S&P is similar. The Dow is well above and in the best position.

QQQ (2m) and IWM (blue). Notice QQQ is still holding at support of yesterday’s consolidation. The S&P is similar. The Dow is well above and in the best position.

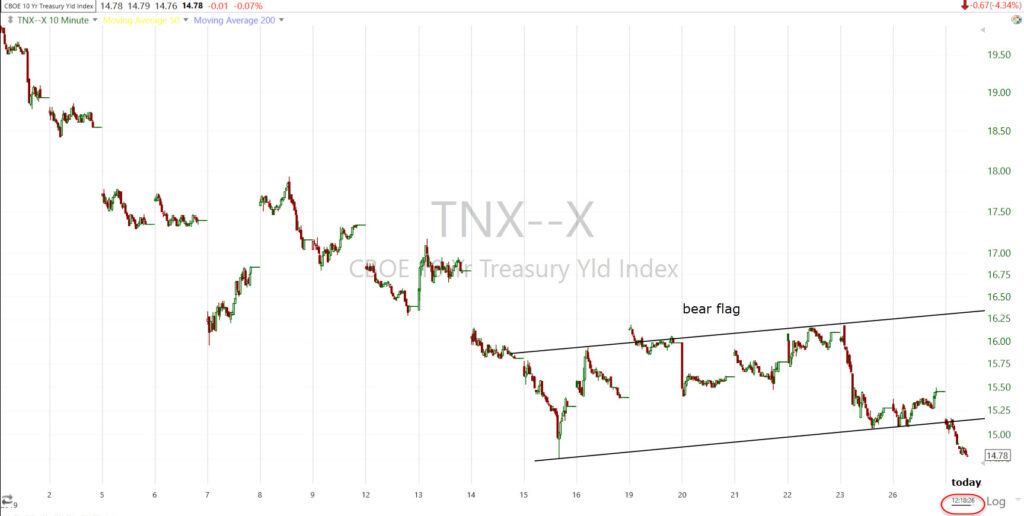

Yields and the cause for all of this.

10-year yield/TNX (10m) bear flag from last week breaking this morning.

Now you know what’s moving and driving the market today, you can look at specific assets like the 10-year yield, Regional Banks, IWM, etc to understand the probabilities of where the broader market is going.

The S&P, Dow and NASDAQ have not yet broke Monday’s consolidation like IWM. I suspect if IWM breaks below Friday’s low at $144.93 as Regional Banks already have, that will change.

IWM (1m) 3C with Friday’s low in white. 3C has been leading negative most of the morning. IWM looks the worst of the majors.

IWM (1m) 3C with Friday’s low in white. 3C has been leading negative most of the morning. IWM looks the worst of the majors.