A.M. Update

Good morning and Happy New Year. I think yesterday and today are the most beautiful days in a year in South Florida, a pleasant 70 degrees and clear skies.

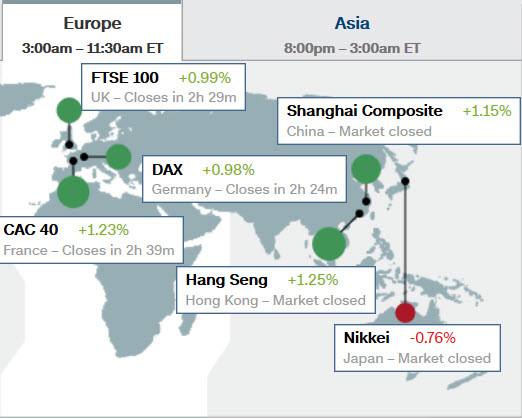

The new year is off to a busy start. Global stocks, including U.S. equity futures, have started 2020 with gains after China announced a new stimulus measure for its economy. The People’s Bank of China said it will cut its reserve requirement ratio for banks by 50 basis points on Jan. 6 and signaled it will continue to implement favorable policy in 2020. The PBOC’s cut injects $115BN into the economy. The cut was in line with market expectations and the yuan barely reacted.

Final December Manufacturing PMI readings from regional European economies were mostly better than expected, though readings from Germany, Italy, Spain, and the U.K. remained in contraction. European factory activity in the bloc contracted for the eleventh straight month. The German manufacturing sector contracted further in December, with the rate of decline in production accelerating for the first time in three months. U.K. manufacturing output matched its sharpest downturn in more than seven years in December and orders for new work from domestic and overseas clients plunged. IHS Markit said Thursday that the industry as a whole shrank for an eighth straight month.

Markets in Japan and New Zealand remained closed

Reuters reported that Chinese officials suspended the Shanghai-London stock connect due to displeasure over the U.K.’s stance on Hong Kong. President Trump said that he will sign the partial trade deal with China on January 15 at the White House.

- China’s December Caixin Manufacturing PMI 51.5 (expected 51.8; last 51.8)

- South Korea’s December Nikkei Manufacturing PMI 50.1 (last 49.4)

- Australia’s December Manufacturing PMI 49.2 (expected 49.4; last 49.9)

- Singapore’s Q4 GDP +0.1% qtr/qtr (expected 0.4%; last 2.4%); +0.8% yr/yr, as expected (last 0.7%). Q4 URA Property Index +0.3% qtr/qtr (last 0.3%)

- India’s December Nikkei Markit Manufacturing PMI 52.7 (expected 51.0; last 51.2)

Airbus jumped after a report it toppled Boeing to become the world’s biggest planemaker. The European giant was set for its best day in three months after Reuters reported it delivered a forecast-beating 863 aircraft in 2019.

- Eurozone’s December Manufacturing PMI 46.3 (expected 45.9; last 45.9)

- Germany’s December Manufacturing PMI 43.7 (expected 43.4; last 43.4)

- U.K.’s December Manufacturing PMI 47.5 (expected 47.6; last 48.9)

- France’s December Manufacturing PMI 50.4 (expected 50.3; last 50.3)

- Italy’s December Manufacturing PMI 46.2 (expected 47.2; last 47.6)

- Spain’s December Manufacturing PMI 47.4 (expected 47.0; last 47.5)

S&P futures are up +0.55%, retracing all of Monday’s losses. Tuesday afternoon I noted a couple of times that VIX had been monkey-hammered in the afternoon, yet the averages did little to capitalize on the decline Tuesday, at least until the late afternoon.

VIX (1m Tuesday)

It appears this was meant to soften up volatility for the start of the new year. VIX futures have a small positive divergence since the decline in the overnight session. It’s not that large yet and we’ll have to see what happens in the cash session.

VIX futures (1m) Tuesday and today.

There are some other interesting charts this morning that could make for an interesting day, although we have to keep the end and start of year re-balancing influences in mind.

The U.S. Treasury market has been unmoved by China’s policy and looks a lot better than it probably should this morning with index futures up. The 2-year yield is unchanged at 1.56%, and the 10-year yield is down two basis points to 1.88%.

The U.S. Dollar Index is up 0.3% to 96.67.

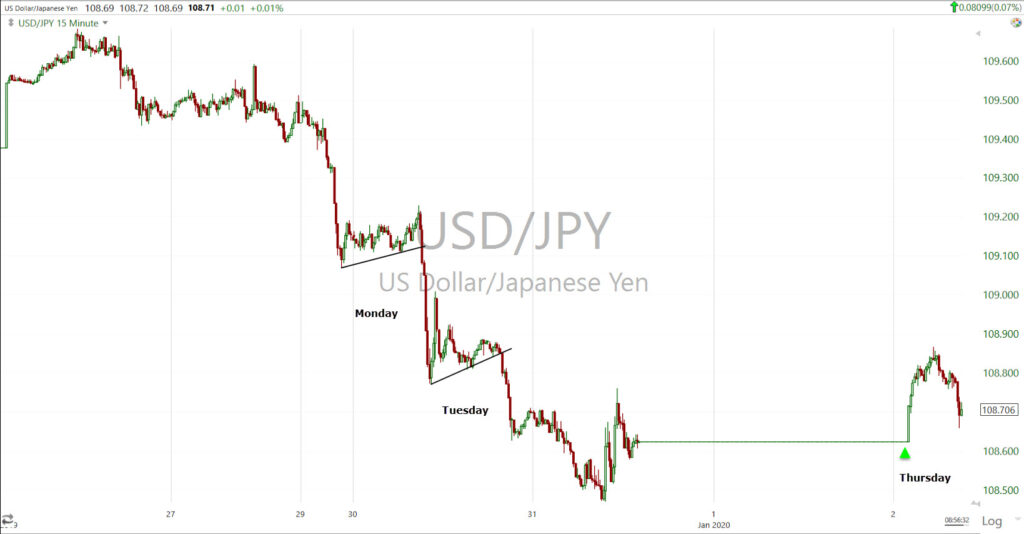

The Chinese yuan barely moved after the PBoC’s action and USD/JPY still has a much more defensive posture for the week.

USD/JPY (15m) coming down (safe haven Yen up vs. Dollar) early this week. It moved a bit higher as futures started the new year and retraced near the low of the week.

WTI crude is up +0.25% to $61.22/bbl. sitting just above the the November-December Broadening formation’s upper trend line.

Also interesting, Gold futures are up +0.45% to $1530 adding to the Christmas week breakout with strong/confirming 3C charts this morning.

To sum up the mixed pre-market, index futures are up, but Treasuries are either unchanged or also up and starting the cash session near session highs, gold is up and copper is flat, USD/JPY reflects a defensive posture.

Here’s an interesting chart…

The Copper:Gold ratio (red 2 min.) started December strong on hopes that a trade deal will spark an economic rebound with yields (10-year yield in blue) following, but turned down at the end of December. The current divergence between the ratio and the 10-year yield suggests the 10-year should turn down (Treasuries up), currently to the tune of about 9-10 basis points which is quite a bit.

The Copper:Gold ratio (red 2 min.) started December strong on hopes that a trade deal will spark an economic rebound with yields (10-year yield in blue) following, but turned down at the end of December. The current divergence between the ratio and the 10-year yield suggests the 10-year should turn down (Treasuries up), currently to the tune of about 9-10 basis points which is quite a bit.

Beyond a short-term edge for treasuries, it’s also telling of economic expectations since the mid-December trade deal.