Wednesday’s Afternoon Update

Heading into the cash close, the averages are near or at session lows. There has been quite a bit weighing on the market including more trouble in cryptos sparking fears or actual selling of equities to meet crypto margin calls. Also the U.S. Dollar Index (currently +0.75%) rising pressures stocks, and yields are mixed across the curve with the 2-year yield currently down -6 bp, but the 30-year yield currently up +6 bp. There have also been a number of disappointing earnings. However, I believe one of the biggest fulcrums for today’s market is concern ahead of tomorrow’s CPI report that has huge potential to move the market either way.

The price consolidation pattern I contemplated in the last update is still holding…

SP-500 (30m) I’m showing this broader view just so you can see that the probable consolidation to the far right, is well within the norm for this market as you can see by the large bull flag in the center of the chart.

SP-500 (30m) I’m showing this broader view just so you can see that the probable consolidation to the far right, is well within the norm for this market as you can see by the large bull flag in the center of the chart.

Here’s a closer look…

SP-500 (5m) – think of this bullishly biased consolidation as a spring compressing, storing up energy for a release. These patterns almost always resolve between 2/3rds of the way to the apex, or at the apex, which just so happens to converge into an apex as of today’s close, ahead of the CPI report tomorrow morning.

SP-500 (5m) – think of this bullishly biased consolidation as a spring compressing, storing up energy for a release. These patterns almost always resolve between 2/3rds of the way to the apex, or at the apex, which just so happens to converge into an apex as of today’s close, ahead of the CPI report tomorrow morning.

3C charts are still mixed as mentioned in the last post with SPY and QQQ looking better than DIA and IWM.

As far as relative positioning of the dollar and yields in the short term…

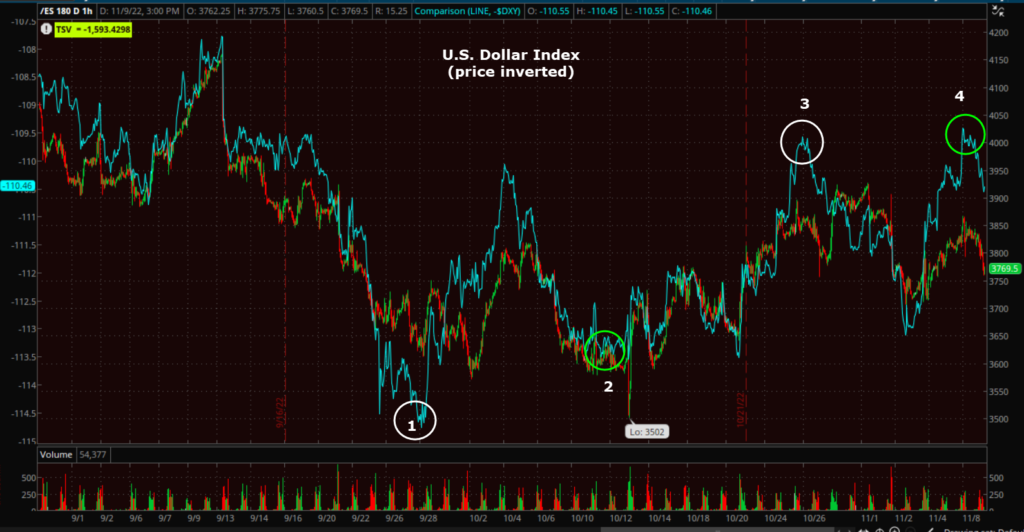

S&P futures (60m) and the U.S. Dollar Index with price inverted for context in blue. If you look at points 1 and 2, the dollar is supportive on this chart in making a higher low at 2. Currently we’re looking at points 3 and 4 and even with the Dollar up today, this is supportive as point 4 is higher than point 3 (meaning Dollar lower).

S&P futures (60m) and the U.S. Dollar Index with price inverted for context in blue. If you look at points 1 and 2, the dollar is supportive on this chart in making a higher low at 2. Currently we’re looking at points 3 and 4 and even with the Dollar up today, this is supportive as point 4 is higher than point 3 (meaning Dollar lower).

We can do the same with rates by just looking at Treasury futures…

S&P futures (5m) and 2-year Treasury futures, meaning in the near term (this week) the 2 year yield is supportive of equities, especially with the divergence between them today as the 2-year is down 6 bp.

S&P futures (5m) and 2-year Treasury futures, meaning in the near term (this week) the 2 year yield is supportive of equities, especially with the divergence between them today as the 2-year is down 6 bp.

S&P futures (5m) and 10-year Treasury futures are also supportive [of equities], but a bit modestly less so.

S&P futures (5m) and 10-year Treasury futures are also supportive [of equities], but a bit modestly less so.

At the long end (25y+ Treasury futures), we get a different perspective where the S&P futures have caught down to the 30y treasury futures.

At the long end (25y+ Treasury futures), we get a different perspective where the S&P futures have caught down to the 30y treasury futures.

Yes, it’s a very mixed set of messages.

As for Treasury futures, the shorter term look like yields could continue to come down, but as you move out on the curve, longer term yields look as if they could come down too as they are at this moment, but probably less so than the short end and all of this will probably change in the morning, but right now these charts are mostly supportive.

There are some more concerning issues such as HYG’s relative price weakness, but that’s somewhat offset by my broader credit index holding up well.

My take is the same. The CPI report will be important, but it appears to me the market is set to rally into a favorable report. At this moment just before the close, yields are coming down more, but the averages remain at session lows.