Daily Wrap

Index futures declined last night in the Asian session on news of a 2nd wave of infection in Wuhan, China banning Aussie beef, and Trump banning US pension fund investment in China, but index futures blew it off and advanced to open the cash session higher. You may have noticed most of the gains the past few weeks have been in the lighter overnight market. Small Caps came under immediate downside pressure at the cash open as Regional Banks fell.

The market spent several hours trading on either side of unchanged during the Senate’s COVID-19 hearings in which NIAID Director Fauci told senators that “consequences could be really serious” if states ease restrictions too soon and without reaching “checkpoints.” It may “trigger an outbreak that you might not be able to control.” Fauci also said at least eight Covid-19 vaccine candidates are in development, though he doubted any will be ready by fall.

Fed officials said the possibility of massive bankruptcies could create a lasting scar, and expressed the potential need for more fiscal stimulus. Thanks to relief efforts thus far, the U.S. posted a record $737.9 billion deficit in April.

Stocks fell around 1 p.m. on news of legislation put forth by Senate Republicans to impose sanctions on China, something VVIX and USD/CNH have been fretting over recently.

Selling really picked up into the final closing hour, certainly not helped by LA County reporting it will extend its stay-at-home order for 3 more months.

SP-500 (5m) from the open (blue). The last week’s trend was broken on the China bill news, but definitively broken the last hour. S&P ended at session lows, which is always bearish, but above its key range level around $2864.

Averages

Small Caps Russell 2000 was the worst due to weakness in Regional Banks.

S&P 500 ⇩ -2.07%

NASDAQ ⇩ -2.01 %

DOW JONES ⇩ -1.89 %

RUSSELL 2000 ⇩ -3.46 %

All of the averages ended with a daily bearish engulfing candle. The S&P’s swallowed the prior 3 sessions.

SP-500 (daily)

Dow (15m) after failing to rally to a higher high (only NASDAQ did), the break below the key $24,000 is more bearish, but it probably shouldn’t be that surprising given Dow Transports failed to even rally back above 8400 (relative weakness from Transports).

Dow (15m) after failing to rally to a higher high (only NASDAQ did), the break below the key $24,000 is more bearish, but it probably shouldn’t be that surprising given Dow Transports failed to even rally back above 8400 (relative weakness from Transports).

Dow Transports (15m) lost -2.4% and broke the week-plus flag.

Regional Banks weighed on small caps this morning as they follow in the footsteps of the KBW Bank index- they are leading IWM lower.

IWM (15m) the $126 level is even more important as the intermediate trend converges with the 2018 low (128.81). 3C has been negatively divergent above the $126 area.

IWM (15m) the $126 level is even more important as the intermediate trend converges with the 2018 low (128.81). 3C has been negatively divergent above the $126 area.

NASDAQ 100 (15m) rising wedges are not my favorite price patterns, but they do have a bearish bias and this one came to an apex yesterday. The rule of thumb is that wedges retrace their base, that would be around 8700-8880.

3C was reflecting the weakening tone into the wedge’s apex, likely driven by weak hands chasing prices higher on positive sentiment, not strong conviction of pros.

QQQ (3m)

S&P sectors

Selling was broad-based with all 11 sectors lower. The Technology sector did some catching down this afternoon. Real Estate was notably weak as REITs came under pressure earlier today.

Bank and airline stocks were among today’s weakest performers, which was made evident by the sharp declines in the Regional Banks -5.0% and the U.S. Global Jets ETF (JETS -4.3%). Bank stocks may have felt additional pressure after President Trump called for negative interest rates, which is probably what Jay Powell will push back against tomorrow.

Airline stocks were pressured by Boeing’s (BA -2.9%) CEO Calhoun telling NBC’s “Today” show that a major U.S. airline could go bankrupt because of COVID-19 disruptions.

While closing red, the defensive Consumer Staples and Utilities both showed better relative performance.

Materials ⇩ -1.53 %

Energy ⇩ -1.76 %

Financials ⇩ -2.61 %

Industrial ⇩ -2.81 %

Technology ⇩ -2.06 %

Consumer Staples ⇩ -0.84 %

Utilities ⇩ -0.88 %

Health Care ⇩ -1.52 %

Consumer Discretionary ⇩ -2.19 %

Real Estate ⇩ -4.25 %

Communications ⇩ -1.95 %

Like the major averages, most S&P sectors broke recent week-long trends, some are in worse position than others.

Technology sector (15m) rising wedge like the Tech-heavy NASDAQ 100. The $89.75 area is a key level for the sector and also near the wedge’s base.

Materials sector (15m) has spent the last week rising in a bearish flag-like pattern and closed below its own key level after failing to make a higher high.

Materials sector (15m) has spent the last week rising in a bearish flag-like pattern and closed below its own key level after failing to make a higher high.

Energy sector (15m) slid below this 4 week trend, but not definitively.

Energy sector (15m) slid below this 4 week trend, but not definitively.

Industrials (15m) are uglier, similar to the weaker price action of Transports, also a bearish-flag like many other cyclical sectors.

Industrials (15m) are uglier, similar to the weaker price action of Transports, also a bearish-flag like many other cyclical sectors.

Consumer Staples (60m) are still constructive

Consumer Staples (60m) are still constructive

The banks are the most suspect and have been since early last week.

KBW Bank Index (60m) bearish price action since breaking down last week.

KBW Bank Index (60m) bearish price action since breaking down last week.

The Financial sector (10m) traded to its lowest in almost 4 weeks. The sector hasn’t looked good for a while. Even though it wasn’t overtly selling off the last week, it didn’t come close to challenging the high from the end of April. The next important level to be aware of is $21.

The Financial sector (10m) traded to its lowest in almost 4 weeks. The sector hasn’t looked good for a while. Even though it wasn’t overtly selling off the last week, it didn’t come close to challenging the high from the end of April. The next important level to be aware of is $21.

Regional Banks (60m) did some catching down to the KBW Bank Index with a definitive trend break today. This group’s price action mirrors that of small caps and is leading them lower.

Regional Banks (60m) did some catching down to the KBW Bank Index with a definitive trend break today. This group’s price action mirrors that of small caps and is leading them lower.

IWM (60m) with a similar large flag-like pattern.

Internals

NYSE Decliners (2172) are 3-to-1 over Advancers (686) which isn’t surprising with all 11 sectors down, it was Monday that the market looked much worse than the headline indices led on. Volume was a little lighter at 939.5 mln. shares.

There’s no single Dominant price/volume relationship. Dow and S&P are biased toward Close Down/Volume Up, but not significantly over Close Down/Volume Down. The former would complete the 3 conditions I look for to indicate 1-day oversold, the later would rule out a 1-day oversold condition.

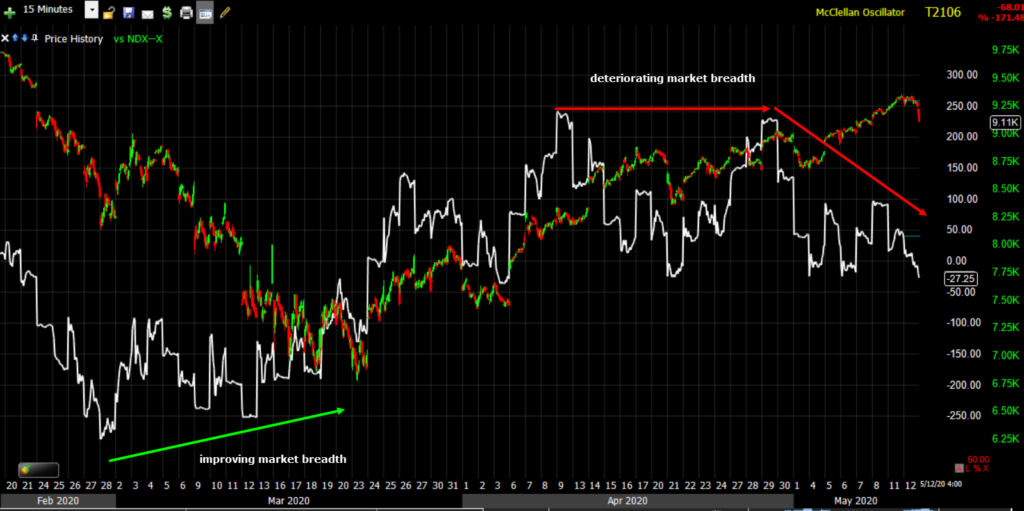

SP-500 (15m) changing market breadth/participation

Treasuries

U.S. Treasury yields declined amid an uptick in demand for the safe-haven asset and that was one notable change apparent early this morning. The 2-year yield declined two basis points to 0.16%, the 10-year yield declined five basis points to 0.68% and the 30-year yield -6 basis points to 1.38%.

Today’s 10-year Treasury auction priced at a record low and had spectacular demand.

Currencies and Commodities

The U.S. Dollar Index declined -0.3% to 99.97.

USD/CNH (1m) yuan dropped on the news that Senate Republicans are introducing legislation to sanction China. The currency market has been reflecting the risk of deteriorating relations and negative economic consequences for more than a week.

USD/CNH (1m) yuan dropped on the news that Senate Republicans are introducing legislation to sanction China. The currency market has been reflecting the risk of deteriorating relations and negative economic consequences for more than a week.

USD/CNH (4h) continues to consolidate in a bullish flag, a breakout above 7.12 would be bearish for risk assets like stocks.

WTI crude rose +5.3% to $25.76/bbl.

Copper traded lower as gold and silver continue to consolidate.

Summary

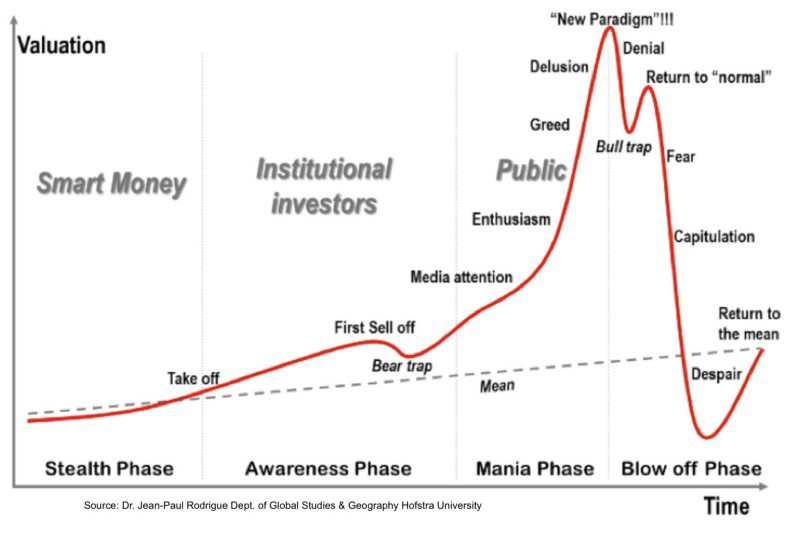

I’m not surprised at the weak price action today given things like the dwindling participation, the ugly price action from banks, and negatively divergent 3C. I’m a little surprised it has taken this long, but at this point the market is running more on mass psychology (optimism) than anything else. Fear and Greed often move to extremes and stay there longer than what seems reasonable, and more so during counter-trend rallies early on in bear markets… The “return to normal” following the “denial” phase, complete with the same 5 or 6 mega-cap or FAANG stocks leading the advance.

The weakness was surprising on a day that the Fed announced they’ll be in the market buying credit ETFs. On that note, I’d expect the market to be relatively calm and/or supported ahead of Jay Powell’s talk tomorrow morning at 9 a.m. E.T. but the last hour of the day and the close were ugly, the kind of price action that generally sees follow through on the downside. Most of the averages and sectors have some important pivotal level nearby, several others, most notable banks, have already crossed the Rubicon.

Finally, a chart I’ve posed a half dozen times over the last week, Wells Fargo (-3.6%). WFC closed at a new 9 year low today. No dip buyers, not even oversold buyers despite being down 8 of the last 9 days.

WFC (daily) the price action turned bearish a couple of weeks ago revealing nothing more than a big bearish consolidation, and has since broke down.

WFC (daily) the price action turned bearish a couple of weeks ago revealing nothing more than a big bearish consolidation, and has since broke down.

The hourly chart illustrates just how bearish price has been since breaking a significant trend…

WFC (60m)

If I had no idea what the broader market was doing and I had to judge by this chart alone, I’d think the S&P were already starting a second major leg down and at or heading below the March low. I’m set with my short in small caps lifted to size on Friday. I may add something else in the next few days. I don’t have a downside target yet, but I’m thinking 10% over the next month is not unreasonable.

Overnight

S&P futures are down -0.7% and safe haven Treasury futures are higher.

S&P futures (7m) pick up in selling the last hour of the day (yellow) and as price broke under $2900.

VIX futures appear to have broken the downside pressure regime the last hour of the day as selling across the market picked up and buyers surged to volatility. I wouldn’t be surprised to see volatility come under pressure again overnight given Powell in the morning, but I don’t see it now.

VIX futures (1m) 3C was leading lower this morning, and confirmed in line this afternoon.

WTI crude is down -2.1%. API reported a bigger than expected inventory build after the close.

It’s early, but the tone from index futures, commodities, treasury futures and currencies is still risk-off.

Looking ahead, Jay Powell speaks at 9 a.m. ET, investors will receive the Producer Price Index for April and the weekly MBA Mortgage Applications Index on Wednesday.