Intraday Market Update

11:27 a.m. ET

The story about China potentially asking for flexibility in meeting phase I trade deal obligations (knock-on effect of the corona virus), has taken the wind out of the sails from the opening rally.

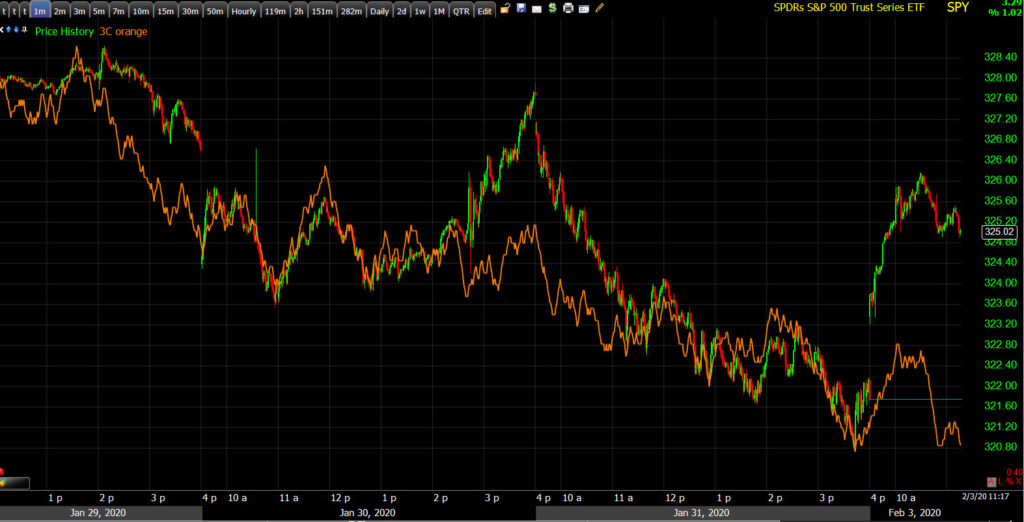

SPY (1m) 3C was moving toward confirmation shortly after the open, but was stunted shortly after 10 a.m. It’s not a strong signal either way at this point so I’d expect some more lateral consolidation intraday.

SPY (1m) 3C was moving toward confirmation shortly after the open, but was stunted shortly after 10 a.m. It’s not a strong signal either way at this point so I’d expect some more lateral consolidation intraday.

As for overall price action, nothing significant has changed.

Dow (15m) correcting from Friday’s decline, but not making a higher high or anything that changes the near-term technical outlook.

Dow (15m) correcting from Friday’s decline, but not making a higher high or anything that changes the near-term technical outlook.

It’s the same case for the Dollar-Yen…

USD/JPY (30m) small consolidation from Friday’s low, resistance at the lower trend line of last week’s consolidation.

And a number of S&P sectors look similar. Here’s the industrial sector (+0.7%) as an example…

Industrial sector (15m open at white arrow) bouncing up to local resistance (red arrow).

Industrial sector (15m open at white arrow) bouncing up to local resistance (red arrow).

Crude Oil (-2.1%) is at cash session lows, as is the Energy sector (-1.2%) which is the only S&P sector lower. I don’t think it’s significant enough to drag the broader market lower on its own, but I’m watching for any other sectors to crack. Today really looks like last Tuesday. The market started out strong after an ugly prior trading day (Monday) and held up well into Apple’s(+1.1%) earnings after the close. The difference is that today it’s Alphabet (GOOG +2.9%) reporting after the close. I don’t see any reason yet to expect anything different yet, but we’ll see how things develop. The market will likely also be paying attention to voting in the Iowa Democratic primary.