Intraday Market Update

1:48 a.m. ET

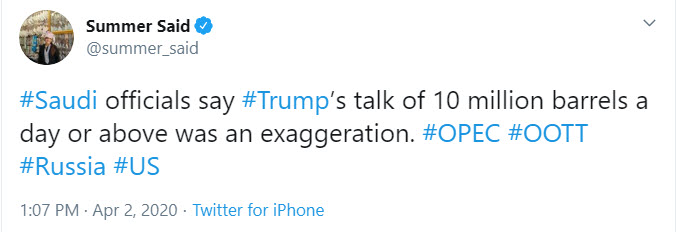

The averages came down since the last update and here’s the reason from a WSJ reporter…

SP-500 (2m) broke below the intraday up trend around $2500.

The S&P could still put in a higher low, but as mentioned earlier, the currency and bond markets were not very enthusiastic about the news.

Crude is still holding significant gains.

Each S&P sector looks a bit different. I think the Financial sector is a happy medium.

It remains to be seen, but this looks like it could be a symmetrical triangle which is indecision. The consolidation has no bullish/bearish bias of its own, but the preceding trend (down) gives is a bearish bias. And the sector mirrors the message from the bond market.

The near term outlook is choppy/uncertain and more sideways. I’ll continue to look for an edge to develop either way.