Pre-FOMC Update

The FOMC is less than an hour. The market is now pricing in a 71% chance of a 25-basis points cut, Additionally there will be updated forecasts for the economy and path of interest rates. Fed Chair Powell will also likely be asked to discuss the recent volatility in the repo market, where the New York Fed recently had to inject liquidity for the first time since 2008 to keep overnight borrowing rates in check. Some are now even expecting some sort of QE to be launched in reaction to the dollar funding squeeze.

S&P has slipped a little below the week’s trend -0.4%, Dow -0.3%, NASDAQ slipped more below the week’s trend -0.6% and small caps displaying clear relative weakness -1.2%.

Yields have been suggesting a deeper pull back today for the market averages.

SP-500 (1m this week) and 10-year yield leading lower (-6 b.p.)

SP-500 (5m)

The last 45 minutes has seen some damage on 3C charts.

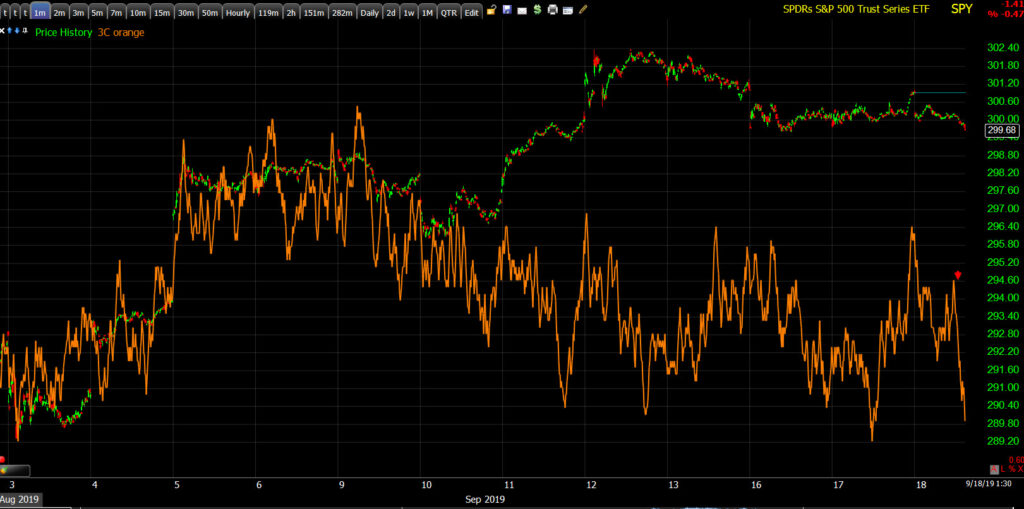

SPY (1m)

Ten of 11 sector are lower, only the defensive Utilities sector (+0.6%) is higher, while the Energy (-0.8%) and Industrials (-0.8%) sectors lead today’s decline. The latter has been weighed on by Transports (-1.9%) after FedEx (FDX -13.6%) disappointing earnings. Retail shows relative weakness (-1.5%), interestingly as yields are higher. Higher yields last week sparked the growth to value rotation. Lower yields today are causing a little unwind of the rotation.

Crude -2.3% to $57.75, back into the $57-$58 range that crude was rejected from at the start of last week.

Hedging activity is showing up as well in volatility’s term structure, the first time I can recall seeing this this month.

SP-500 (5m) and Volatility’s term structure flattening today.

I’m going to listen to the FOMC and Powell, I’ll post a quick update after the policy statement and before Powell’s presser. The last meeting the Dollar and yield curves gave away the market’s disappointment well before Powell spoke, which was the catalyst to move stocks lower.