Stock Market Update – February 8, 2021

Despite strong follow through performance from stocks today, the real story was Tesla(TSLA +1.3%) buying $1.5 bln. of Bitcoin with plans to accept the cryptocurrency as a payment option, and sending the crypto 15% higher to an all-time new high. The continued surge in Micro-caps (mostly biotechs) is the other story of the day.

The positive bias for stocks started in the futures market after Treasury Secretary Yellen (former Fed chair) said on Sunday that the economy can reach full employment in 2022 if a stimulus bill is passed, which is two years sooner than the projection issued from the Congressional Budget Office last week.

This comment fueled the recovery trade in which value, cyclical, and small-cap stocks outperform due to expectations for improved economic, and earnings, growth, but strangely was not confirmed in bonds.

Averages

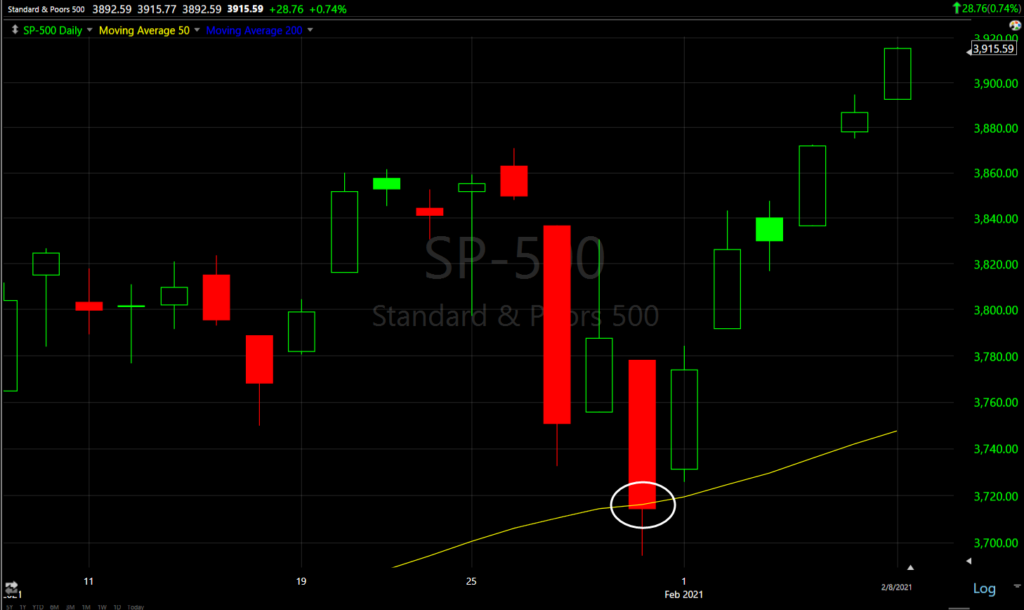

The major averages ended with similar gains. The S&P posted a sixth consecutive gain following through on last week’s strong technical bounce off the 50-day, but Small Caps stood out, due mostly to speculative, illiquid micro-caps gaining +4.1%. Micro-caps have been on a tear to the upside (likely the Reddit traders) since mid-January.

S&P 500 ⇧ 0.74 %

NASDAQ ⇧ 0.67 %

DOW JONES ⇧ 0.76 %

RUSSELL 2000 ⇧ 2.53 %

SP-500 (daily) closing above 3900 for the first time after a strong technical bounce from the 50-day.

SP-500 (daily) closing above 3900 for the first time after a strong technical bounce from the 50-day.

Dow Industrials(daily) just cleared January highs after slipping below the 50-day.

Dow Industrials(daily) just cleared January highs after slipping below the 50-day.

You may recall that Dow Transports (+0.7%) led the Dow Industrials below the 50-day a few weeks ago…

Dow Transports (daily) filled the gap and traded above the 50-day, but for a pro-cyclical rally (at least today), they’re far from leading industrials, rather Transports are lagging behind.

Dow Transports (daily) filled the gap and traded above the 50-day, but for a pro-cyclical rally (at least today), they’re far from leading industrials, rather Transports are lagging behind.

Although VIX (+1.75%) did lose some ground into the close, volatility closed higher displaying relative strength after 3C positive divergences toward the end of last week.

Volatility’s term structure also flattened unusually at the open for the first time in weeks. SP-500 (2m) and volatility’s term structure flattening today

SP-500 (2m) and volatility’s term structure flattening today

Nothing too unusual happened on volatility’s 3C charts today.

VXX (1m) positive divergence around the $16.50 area the last 3 days.

VXX (1m) positive divergence around the $16.50 area the last 3 days.

S&P sectors

The majority of sectors finished lower than the benchmark S&P index, but Energy soared leading a pro-cyclical rally with the sector up 6 days in a row, partly fueled by higher oil prices and Exxon Mobil (XOM+4.3%) receiving an upgrade to Neutral from Underperform at Exane BNP Paribas. Despite Technology putting in decent performance, most of the mega-caps ended the day lower, which isn’t uncommon during a cyclical rotation, but we haven’t seen strong evidence of that dynamic for weeks.

Materials ⇧ 0.83 %

Energy ⇧ 4.18 %

Financials ⇧ 1.29 %

Industrial ⇧ 0.85 %

Technology ⇧ 1.05 %

Consumer Staples ⇧ 0.38 %

Utilities ⇩ -0.77 %

Health Care ⇧ 0.12 %

Consumer Discretionary ⇧ 0.57 %

Real Estate ⇧ 0.21 %

Communications ⇧ 0.39 %

I’ve posted several stocks with strong charts over the last few weeks and most of them did very well again today.

Overstock (OSTK) was posted on February 1st in the Daily Wrap. OSTK added +7.3% today and is up almost 25% since it was first posted.

OSTK (daily) cleared local resistance at $94. The measured move target is difficult because there aren’t too many consolidations, but I believe the stock could double and if I had to come up with a target based on price action, I think it could do far more than that, up to about $250.

OSTK almost certainly benefited from cryptocurrencies rally today, as did others with exposure including Paypal (PYPL +4.7%), NVIDIA (NVDA +6.2%), and MicroStrategy (MSTR +29.2%).

Novavax (NVAX +10.25%) I’ve been following for a while, first posting May 26 of 2020 and more recently November-January looking for the next leg up out of a triangle (bullish) consolidation.

NVAX (daily) up +564% since first posting in May, but more recently it has broken out from another bullish triangle consolidation.

NVAX (daily) up +564% since first posting in May, but more recently it has broken out from another bullish triangle consolidation.

Taking a closer look, the price action is very bullish.

I’m still looking for a target around $385 (about 20% higher) on this leg, but I would definitely consider a trailing stop to protect profits.

Zoom Video (ZM -2.1%) I’ve featured numerous times since the summer, most recently on February 2nd. ZM is more of a stay-at-home trade that isn’t likely to do well on days like today with a pro-cyclical bias, but it’s technical outlook still looks constructive.

ZM (daily) looks very similar to the other stocks above with a large bullish wedge of 4-5 months and a recent breakout (up about 5% since first posting).

ZM (daily) looks very similar to the other stocks above with a large bullish wedge of 4-5 months and a recent breakout (up about 5% since first posting).

A closer look…

ZM (60m) I prefer a stop under the most recent small bull flag or under $350 on a closing basis, so I think it could still be bought in the area or on pull backs closer to $350. I have a measured move target of approximately $785 or some 90% higher, which makes the current downside risk of about 15% more palatable. Still, a pull back toward $370-$350 would make the risk/reward even more appealing.

ZM (60m) I prefer a stop under the most recent small bull flag or under $350 on a closing basis, so I think it could still be bought in the area or on pull backs closer to $350. I have a measured move target of approximately $785 or some 90% higher, which makes the current downside risk of about 15% more palatable. Still, a pull back toward $370-$350 would make the risk/reward even more appealing.

Internals

NYSE Advancers (2311) easily outpaced Decliners (875) with Small Caps’ and Micro Caps’ outperformance, but volume (970.5 mln shares) continues to fall as the rally extends.

There is no Dominant price/volume relationship and no 1 day overbought condition.

However, new NYSE 52 week lows climbed once again. In fact they have climbed every day of the rally from the 50-day moving average just over a week ago, which shouldn’t happen in a healthy advance.

SP-500 (daily) and NYSE 52 week lows

Treasuries

U.S. Treasuries finished mixed after investors bought the early weakness in longer-dated maturities. The 2-year yield increased two basis points to 0.11%, while the 10-year yield decreased one basis point to 1.16% after touching 1.20% at its intraday high. The 30-year yield fell 3 basis points 1.94% after touching 2%. A such, the bond market did not confirm the pro-cyclical bias in stocks, or at least several S&P sectors like Energy and Financials.

Currencies and Commodities

The U.S. Dollar Index decreased -0.1% to 90.96 in a continuation of last week’s pull back following a breakout from an inverse H&S base.

In my view Dollar strength is still the most underappreciated risk out there for stocks as the S&P and Dollar still have a 90-day correlation approaching -90.

SP-500 (5m) and a proxy for the Dollar (inverted). The market has rallied as the Dollar has fallen since last March, but recently the Dollar put in an inverse H&S base and started to breakout, which appears as the Dollar (inverted) leading the S&P lower a few weeks back, leading to the worst week for the market since September. Even though the Dollar has pulled back a bit recently, it’s still quite divergent with the S&P (inversely), especially during this last week’s rally.

WTI Crude oil closed up +1.9% to $57.97/bbl, which helped lift the Energy sector and contributed to the pro-cyclical bias of the day.

Gold futures put in back-to-back gains, adding +1.2% to $1,831.90/oz. However, technically speaking it hasn’t exited the woods yet.

GLD (30m) just traded back up to the 4 week lateral range. Gold will have to clear approximately $1880 before I get excited about the technical outlook. There has been a lot of oor technical price action for months.

GLD (30m) just traded back up to the 4 week lateral range. Gold will have to clear approximately $1880 before I get excited about the technical outlook. There has been a lot of oor technical price action for months.

SLV gained +1.75% and looks a little better than GLD to me presently.

SLV (30m) it’s not so much the bounce, but the fact that there wasn’t another impulsive leg lower as a small bear flag broke last week. SLV is trading at the top of a massive 6 month triangle consolidation after a failed breakout attempt a week ago so in my view it is not out of the woods either, bt the outlook would improve with prices trading above the triangle’s upper trend line. After that the gap from last week is the next likely resistance zone so there’s still a lot of work to do.

SLV (30m) it’s not so much the bounce, but the fact that there wasn’t another impulsive leg lower as a small bear flag broke last week. SLV is trading at the top of a massive 6 month triangle consolidation after a failed breakout attempt a week ago so in my view it is not out of the woods either, bt the outlook would improve with prices trading above the triangle’s upper trend line. After that the gap from last week is the next likely resistance zone so there’s still a lot of work to do.

Cryptocurrencies/Bitcoin were the big movers today.

BTC/USD (4hour) with a solid breakout from a bullish consolidation with heavier volume confirming.

BTC/USD (4hour) with a solid breakout from a bullish consolidation with heavier volume confirming.

I posted the chart in the cash session, pointing out that intraday trade was still very bullish even after the initial gains. Bitcoin has added to the gains since.

BTC/USD (15m) bullish triangle consolidation and another leg higher.

BTC/USD (15m) bullish triangle consolidation and another leg higher.

GBTC added +20.6%. The position is up +335% since first buying in mid-June.

GBTC (30m) breaking out convincingly from a large bull flag with volume confirmation. I’m looking for this leg (coming out of this large consolidation) to trade up toward GBTC $70 or about another 50%-55% from here for Bitcoin.

GBTC (30m) breaking out convincingly from a large bull flag with volume confirmation. I’m looking for this leg (coming out of this large consolidation) to trade up toward GBTC $70 or about another 50%-55% from here for Bitcoin.

Summary

Stocks are off to a strong start, following through on last week’s strong technical bounce (which followed the worst week since September). There was a pro-cyclical bias displayed in S&P sectors and Small Caps’ outperformance (at least on the face of it at the index level), although much of that is being led by Micro-caps which are very illiquid and speculative. This appears to be the Reddit traders targeting small Biotechs. The cyclical bias or reflation trade was not reflected in bonds as yields fell at the long end 1-3 bp, which isn’t enough to be a red flag on its own, but the bond market was not confirming today. Much of the gains in yields last week have been attributed to corporate debt issuance rate locks.

Volatility is starting to do its own thing after posting positive divergences in the cash market around mid-week and in VIX futures toward the end of last week. Jay Powell will be speaking Wednesday so we may see some softness over the next 24 hours.

There are some great looking single-name stock charts out there. I’ll keep posting them as they come up as favorable risk/reward opportunities.

Overnight

S&P futures are down -0.1%

WTI crude futures are up +0.45%.

Gold futures are flat, but ended the day with a small bullish consolidation.

The safe-haven Yen is seeing some buying interest tonight, but I don’t think it’s a major issue for the market yet. We’ll see if it accelerates.

Bitcoin futures are up another 6.75% tonight.

Investors did not receive any economic data on Monday. Looking ahead, investors will receive the NFIB Small Business Optimism Survey for January and the JOLTS – Job Openings report for December on Tuesday.

Other events this week include the continuation of earnings season with companies including Honda Motor, Cisco Systems, Societe Generale and L’Oreal reporting; the EIA crude oil inventory report comes Wednesday; Sweden will set monetary policy on Wednesday; Federal Reserve Chair Jerome Powell will speak on a webinar Wednesday; the U.S. consumer price index comes Wednesday; the Lunar New Year public holidays begin in nations across Asia, with China breaking for a week; and Bank of Russia’s policy decision comes out Friday.