The Good, Bad and Ugly

11:03 a.m. ET

In Washington, Senate Majority Leader McConnell (R-KY) repeated that the Senate will vote on the House COVID-19 bill today (unemployment insurance/sick leave) and that the Senate will not leave until a much stronger COVID-19 package is agreed on.

The good…

So far all of the averages are holding above the week’s low. Small Caps are looking better on a relative basis or closer to the benchmark S&P. Dow is the laggard due to Boeing’s (BA -19%) ongoing crash, down -70% the last month, or from from Feb. 12th.

SP-500 (10m) opening the door to a potential higher low, or what some would call an inverse Head and Shoulder bottom.

VIX, which saw its contract roll today, is down 3% showing relative weakness. It is, however, still above trend.

VVIX is coming down sharply today…

VVIX (5m), but also still above trend. It has been my view that for there to be any decent rally of more than a day or so, these trends need to break.

Also on the good side, most S&P sectors have not made a lower low. Consumer Staples is really outperforming only down -1.75% vs. the benchmark -5%.

The bad…

Financials/Banks still under-performing.

Breadth hasn’t improved.

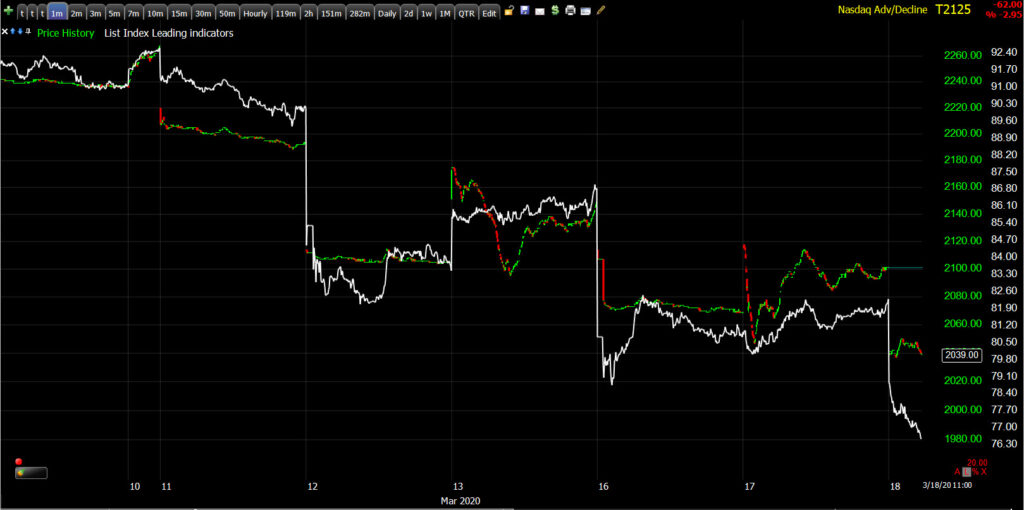

NASDAQ 100 and NDX Composite A/D line is making a slight lower low.

And the ugly…

Energy and Industrials are making new lows, and heading toward the next downside target.

Industrials (5m) target $52.50

Industrials (5m) target $52.50

Crude is an unmitigated disaster

The Aussie (30m) is in free-fall.

The Aussie (30m) is in free-fall.

And Credit markets are ugly.

SP-500 and my equal weight index of HY credit leading lower. Higher Treasury yields recently and crude’s plunge both weigh on credit.

As has been the case every day since this started, we have to take it one step and day at a time, find the high probability scenarios and assess.