PMI Crashes

Economic data this morning is surprisingly bad.

First, Existing home sales for January declined 1.3% to a seasonally-adjusted annual rate of 5.46 million (consensus 5.42 million) from a revised 5.53 million in December (from 5.54 million).

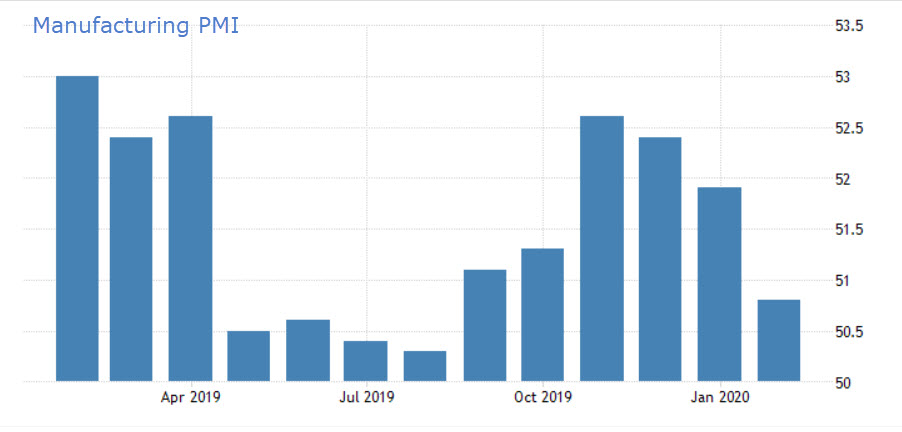

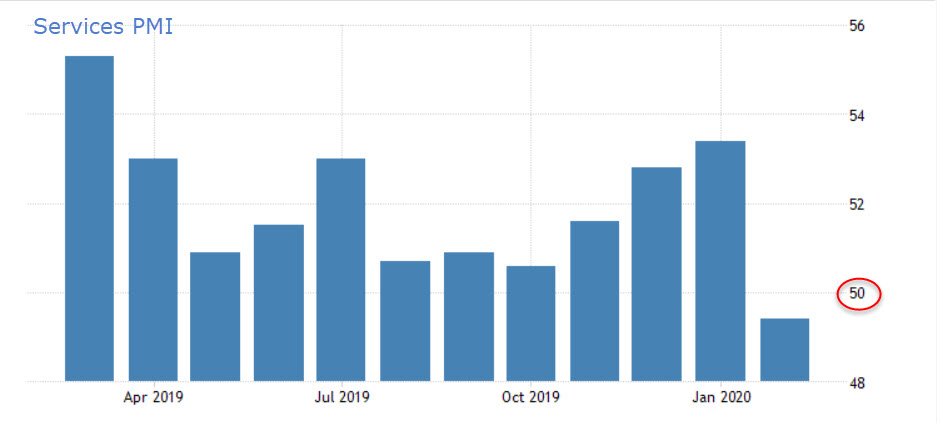

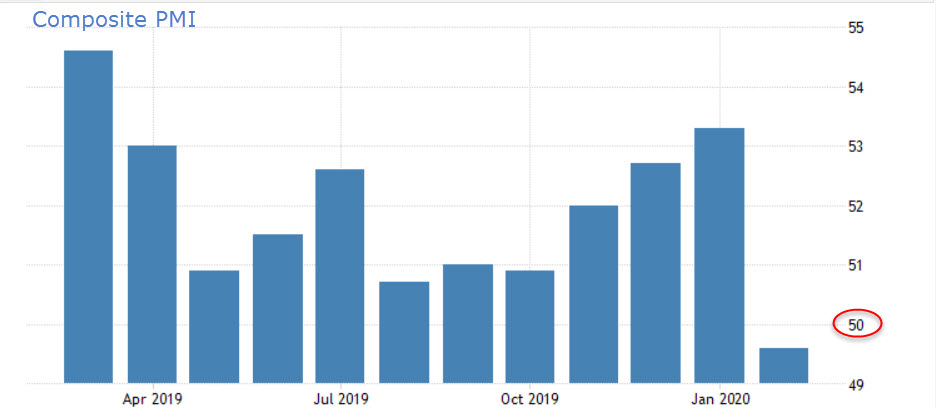

The real surprise for the market is the February Flash PMI readings which missed across the board.

U.S. Feb. Flash Manufacturing PMI 50.8; Est 51.5

U.S. Feb. Services Flash PMI 49.4; Est. 53.4

U.S. Feb. Flash Composite PMI 49.6 vs 53.3

You may recall that Manufacturing PMI had gone into recessionary contraction, but the market blew it off because services remained in expansion, and the U.S. is primarily a services economy. However, manufacturing tends to lead services.

Markit’s manufacturing PMI contradicted ISM and got a bounce in Q3-Q4 2019 (phase I trade deal optimism), ISM did not and continued lower.

Markit’s manufacturing PMI contradicted ISM and got a bounce in Q3-Q4 2019 (phase I trade deal optimism), ISM did not and continued lower.

Again, services has been the market’s hope…

Services PMI crashed into contraction (below 50)

Services PMI crashed into contraction (below 50)

And the composite…

also bounced in Q3-Q4 2019 and just crashed into contraction.

also bounced in Q3-Q4 2019 and just crashed into contraction.

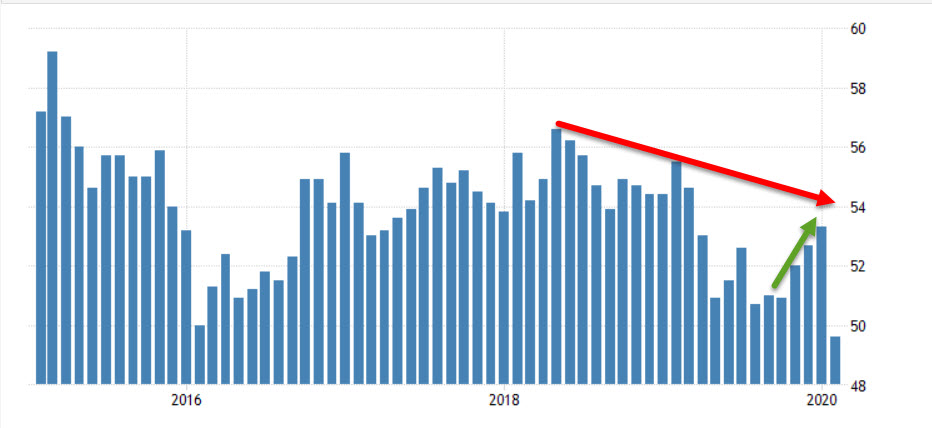

Here’s why I say “bounced”…

Composite PMI- With the exception of the October 2013 government shutdown, this is the lowest reading since the Financial Crisis.

Composite PMI- With the exception of the October 2013 government shutdown, this is the lowest reading since the Financial Crisis.

More from the report….

“The deterioration in was in part linked to the coronavirus outbreak, manifesting itself in weakened demand across sectors such as travel and tourism, as well as via falling exports and supply chain disruptions,” IHS Markit economist Chris Williamson said in a statement.

“With the exception of the government-shutdown of 2013, US business activity contracted for the first time since the global financial crisis in February. Weakness was primarily seen in the service sector, where the first drop in activity for four years was reported, but manufacturing production also ground almost to a halt due to a near-stalling of orders.

“Total new orders fell for the first time in over a decade. The deterioration in was in part linked to the coronavirus outbreak, manifesting itself in weakened demand across sectors such as travel and tourism, as well as via falling exports and supply chain disruptions. However, companies also reported increased caution in respect to spending due to worries about a wider economic slowdown and uncertainty”